1/1/2023

How Are 2023 H-2A Wage Rates Looking?

Jennifer Zurko

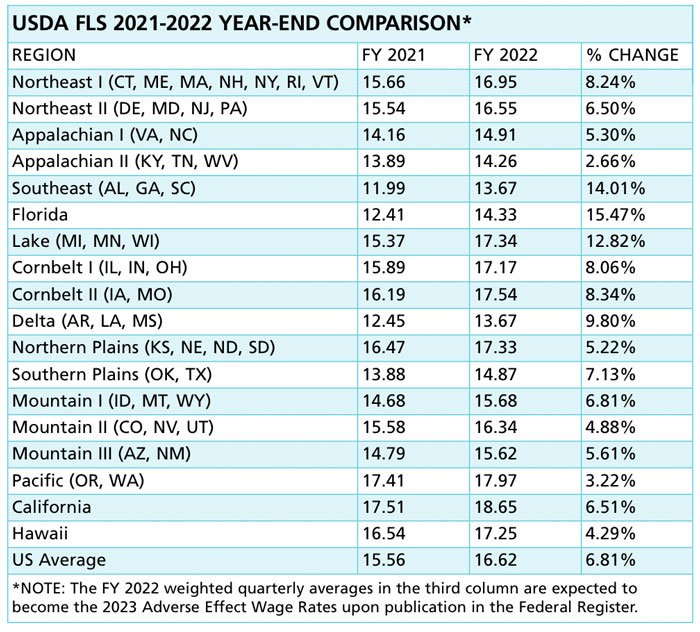

USDA has published the 2022 Farm Labor Survey, from which the H-2A adverse effect wage rates (AEWRs) will be set upon publication in December in the Federal Register. Wages are headed up about 7% (national average). Florida sees the largest increase, with a 15.5% spike. Alabama, Georgia and South Carolina come in next at 14%. California will have the highest wage in the nation—$18.65. A summary of the increases can be found here.

As a refresher, Farm Labor Survey data are used in the methodology for setting the H-2A AEWRs. USDA and DOL also use the data collected to provide estimates and updates on the availability of agricultural workers.

As has been the trend for the past few years, H-2A program use continues to reach new highs. In FY ’22, DOL certified 371,619 H-2A positions, an increase of 17% over the previous year. This growth in the H-2A program is evidence of the incredibly tight labor market. Combined with unsustainable annual AEWR increases, it’s taking a heavy toll on growers and producers. It is worth noting that USDA projects that next year, the US will become a “net importer” of agricultural products, broadly defined. The workforce situation feeds into that.

Any relief in sight? If the Senate advances a farm workforce modernization bill in the next few weeks, growers using the program could see an immediate one-year wage freeze followed by wage caps that would limit annual increases to 3% or so.

—Sara Neagu-Reed, Director of Advocacy & Government Affairs, AmericanHort

Greenhouse and Nursery Employment Survey Results

It’s not been easy finding much information specific to our industry workforce needs and challenges, so AmericanHort seized a rare opportunity to collaborate on a Nursery and Greenhouse Employment Survey with research partners at the University of California-Davis and Arizona State University. The survey reporting and responses clearly show that workforce and employment issues are top-of-mind for greenhouse and nursery growers nationwide. The purpose of the survey was to collect information about how growers are adapting to reduced agricultural workforce availability, usage of the H-2A program in the industry and the extent to which labor-saving technologies are helping mitigate problems stemming from labor

shortages.

Of the 443 growers from 33 states and all regions of the United States participating in the survey, roughly two-thirds reported difficulty hiring the number of employees needed. For every 100 workers growers needed in 2021 to produce at full capacity, they were only able to hire 82, triggering a wide array of coping strategies ranging from investing in mechanization to substituting crops that require less labor-intensive treatment to cutting back production.

Simply stated, with a nearly 20% workforce shortage on average, the green industry is struggling, underperforming and finding every way possible to adapt.

Growers are doing everything possible to adapt to the ongoing workforce scarcity crisis. Nearly half of the surveyed growers used new labor-saving technology in 2021. Of those who did, 50% reported investing at least $100,000 in labor-saving strategies. Interestingly, only half of the respondents indicated that technology reduced labor’s share of their total operating costs. Thus, despite making large capital investments in technology, only some growers found that it reduced workforce costs.

Then there’s the increase in the use of the H-2A visa program. Thirty-five percent of the growers surveyed used the H-2A program in 2021. Many grower respondents indicated concerns with barriers to entry. A good number of horticultural jobs are considered non-seasonal or year-round, and the H-2A visa program can only be used for jobs that are temporary or seasonal in nature.

The key takeaway from the survey: Despite taking actions to help mitigate labor problems, many farmers continue to face workforce challenges. With continued upward pressure on the workforce and input costs, and ongoing negotiations on a Senate version of the Farm Workforce Modernization Act, the results of this survey will help AmericanHort characterize workforce challenges and advocate for solutions to address workforce supply challenges while helping to ensure that the types of horticultural products that American consumers have become accustomed to continue to be produced domestically.

To receive a full copy of the survey report and to download an infographic summarizing survey results, go to AmericanHort.org/EmploymentSurvey.

—Sara Neagu-Reed

USDA Announces New Disaster Relief for 2020 and 2021

In November, USDA announced the long-awaited Phase II of the Emergency Relief Program (ERP). Launched in June 2022, the ERP program has already paid more than $10 million to nursery and floriculture growers. ERP’s Phase I targeted assistance to policyholders of either federal crop insurance or the Non-Insured Disaster Assistance Program (NAP). Meanwhile, USDA says Phase II is “targeted to the remaining needs of producers,” meaning growers without insurance who suffered a qualifying loss may be eligible for payments in the second phase.

In general, ERP Phase II payments are expected to be based on the difference in certain farm revenue between a typical year of revenue, as will be specified in program regulations for the producer and the disaster year. Details will be available when the rule is published [after press time]. This past summer, AmericanHort advocated for this revenue-based approach to account for economic losses unaccounted for by previous disaster relief programs, such as how a tree over time responds to temporary drought or wind damage.

According to USDA, a forthcoming rulemaking will address key details around eligibility and payment rates. However, in general, we know eligible growers will include those with a qualifying natural disaster event in 2020 or 2021, including wildfires, hurricanes, floods, derechos, excessive heat, winter storms, freeze (including a polar vortex), smoke exposure, excessive moisture, qualifying drought and related conditions.

“Qualifying drought” counties rated by the U.S. Drought Monitor as having a D2 (severe drought) for eight consecutive weeks or D3 (extreme drought) or higher level of drought intensity.

Also, for growers who want to get a head start, USDA encourages producers to begin gathering documentation to support a revenue loss claim, including a Schedule F (Form 1040); and Profit or Loss from Farming or similar tax documents for tax years 2018, 2019, 2020, 2021 and 2022 for ERP and for calendar years 2018, 2019 and 2020 for the Pandemic Assistance Revenue Program (PARP).

In the coming weeks, AmericanHort will provide more information on how growers may take advantage of Phase II assistance after USDA releases its rule.

—Evan Lee, Director of Policy & Government Relations, AmericanHort

AmericanHort Joins Farm Groups to Reaffirm Federal Pesticide Preemption

Plants and managed landscapes enhance our environment, as well as human health and well-being. Growers and customers need a range of pest management tools for successful plant production and use, but government regulation at federal, state and local levels increasingly pose a challenge to filling the toolbox.

In November, AmericanHort joined more than 300 farm groups in calling on Congress to reaffirm federal preemption of state laws that create uncertainty around pesticide use and access. Under Federal law, the Environmental Protection Agency (EPA) makes decisions on how pesticides may be labeled and used. States, in general, regulate the sale and use of pesticides in concert with the EPA, but may not require additional or different pesticide labels. The principle of federal preemption over state pesticide labeling gives users clarity nationwide, avoiding a patchwork of state rules that contradict EPA’s scientific findings and, in turn, may disrupt commerce and access.

A lack of certainty on EPA-approved, science-based nationwide labels is a concerning trend for growers and customers who count on access to a range of crop protection tools. In recent years, the preeminence of federal authority over pesticide regulation has been challenged by state laws, like California’s Proposition 65. For example, California categorizes glyphosate, the active ingredient in Roundup, as carcinogenic, despite EPA findings to the contrary.

Bayer AG, manufacturer of Roundup herbicide, earlier this year requested the U.S. Supreme Court review a lower court verdict in a landmark Roundup product liability case arising out of California’s law. The Biden Administration through an amicus brief to the court reversed long-standing policy regarding federal preemption over pesticide labeling, adopting the position that federal law does not preclude states like California from imposing additional labeling requirements.

The letter follows an earlier call in May by AmericanHort and 54 agriculture associations for the Biden Administration to withdraw its brief and restore the traditional interpretation of strong federal authority over labels. As the U.S. Supreme Court ultimately decided against reviewing the Bayer case, the remaining recourse for advocates is Congressional action clarifying the state and federal roles in pesticide regulation.

An opportunity for Congress to act may come soon enough. Pesticide registration fees are due for congressional renewal on September 30, 2023, with the expiration historically representing an opportunity to review and update federal pesticide rules more broadly.

—Evan Lee

News, views, commentary and event coverage about the policies and legislation that directly affect our industry. Share your thoughts, opinions and news with me: jzurko@ballpublishing.com.