7/1/2022

Are Your Prices Right?

Jennifer Zurko

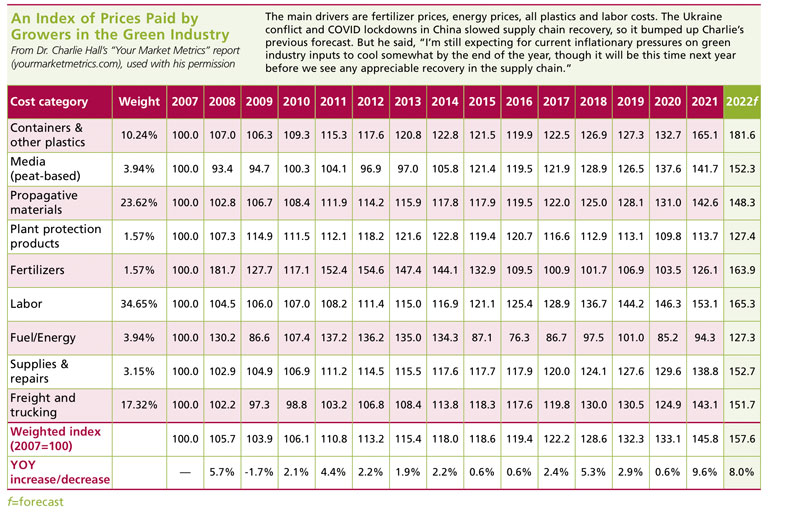

Other than the horrible weather that made the spring season we rely on so painfully late, the rising cost of inputs is what’s on the mind of everyone in the hort biz. Regardless of the role you play in our industry, you’ve been affected by the rising costs of goods, freight and other services. (And that includes your favorite trade publication, as well.)

Times of pressure and stress often lead to creative thinking and looking at new ways of doing things. Maybe it’s been a while since you’ve really analyzed your costs and you’ve been on auto-pilot for a while. Or you’ve been stuck in the “we’ve-always-done-it-this-way” hamster wheel. Or you haven’t raised your prices in a while because you’re afraid of the risks involved. No matter the reason, perhaps it’s time for a change of mindset.

“Before all this, there was certainly an issue of us inappropriately keeping our pricing down. And this is forcing us to face it,” said Raker-Roberta’s Kelly Staats.

I asked a handful of industry folks how they’re handling the substantial rise in business costs and what they’ve done to offset them to continue to be profitable. Here’s what they said.

Bill Swanekamp

(Newly Retired) Owner, Kube-Pak (Allentown, New Jersey)

Bill begins our conversation with: “Pricing, of course, is a complicated process.”

But, according to Bill, the reason why it’s so complicated is because part of it is determining your overhead. What does it cost to grow that crop? How do you allocate your insurance? All the maintenance and repairs that have to be done? These are the questions every business owner needs to ask themselves. Many businesses find themselves falling short because they’re not allocating enough to their overhead.

To understand how to calculate your overhead, Bill said you have to think about what he calls “the three S’s”—space utilization, seasonality and shrinkage. A mistake many growers make is assuming they fill their greenhouse 100% of the time, 52 weeks a year. Bill said he’s been tracking Kube-Pak’s space utilization for almost 15 years and his data shows that they fill their greenhouses right around 55% in the spring and 45% in the fall.

Say you use 50% of your greenhouse space—if you calculate your overhead at 50 cents per square foot per week, your overhead is $1 a square foot per week. Overhead doubles the cost and it’s crucial, now more than ever, to really know those costs.

Bill estimates that costs for pots, flats and baskets have gone up 20% to 30% and to offset that they raised their prices between 10% and 15%, depending on the product.

“There were virtually no complaints [from our customers]. It was almost as if they expected it,” said Bill. “There was very little resistance. We were sold out of our plug space the second week of January.”

Kube-Pak cut back on some of the products they offer this year, culling out 2,000 to 3,000 plug line items and about 100 on the finished plant side. These were what they considered “fringe items” that weren’t getting a lot of orders placed.

“The fewer SKUs you have, the more efficient you can be,” stated Bill. “Less handling, shorter order lists—everything is compounded the more you add to your product line.”

Kube-Pak was able to save on energy costs because they locked in their fuel cost five years ago with what’s called a “futures contract.” But now that contract has ended and he anticipates those costs to go up at least 30%.

In the labor department, Kube-Pak was lucky that they were able to fill every open position in the greenhouse, but they did raise their wages significantly this year—between 10% to 20%. Bill said that there’s a new Amazon warehouse 5 miles from Kube-Pak, so it’s not other greenhouses they’re competing against. But even with raising their wages, Bill said their total payroll is only up 1% compared to last year. When I asked why that was, he simply said, “You pay people more money, you get more out of them.”

As for looking ahead, Bill is stepping back from the business, which is now run by his son Sean and nephew Rob, Jr. But he did have some thoughts.

“We’re going to look at the hardgoods and we’ll look at what percentage that goes up. Then we’ll look at the labor and how much that’s going to go up,” said Bill. “I can’t see us not going up at least 5% to 10% for 2023.”

Kelly Staats, Sales Manager, and Jim Whitehill, CFO

—Raker-Roberta’s (Litchfield, Michigan)

Raker-Roberta’s pricing strategy involves a deep dive into what it takes to grow each item—sowing/sticking, time for making corrections or fixes, identifying germination, and converting counts and quality. Jim said that each step has a cost center assigned to it where they keep close tabs on the hours spent on each product, which, in turn, drives the final price. Because of this level of detail, their pricing program takes months to complete, but they’ve found this is the best way to develop the fairest system.

This year, Raker-Roberta’s raised their prices, of course, because of increasing costs. Kelly said there are always plans in the budget for an increase in costs, but this year they realized they didn’t budget enough to cover how much they went up.

“I don’t think anyone expected the inflationary costs that we all experienced this year,” she explained. “We knew things were going to go up last year when we published our pricing, but it didn’t offset everything.”

So starting April 1, they started applying a surcharge on orders, which will continue through October to offset the continuously rising costs. Jim said they’ve seen a 25% to 30% increase in freight costs; they originally planned for 12% to 15%.

“You can’t continue to eat that,” he said.

But instead of just using a blanket system to raise prices across the board, they took a more strategic approach. They were keeping a close eye on costs on a weekly basis, and once the bills exceeded the original plan, they started to pass along the price increase. But not every customer experienced the increases; Kelly said most of their customers had already placed their orders before April 1. The ones who did accepted it as par for the course.

“On the whole, the feedback I’m getting is it’s not a surprise because they’re experiencing it on everything. It is what it is,” said Kelly. “We’re all just beat up.”

There is reason for optimism, though, and that’s the fact that people still want our product. Kelly and Jim said demand is still high despite the cost increases, which they hope will eventually even out.

“We feel like if customers can get through this year and end up okay, overall it will be a really good thing for our industry,” said Kelly. “It will teach us all the value of what we do and that the consumer is willing to pay for what we do.

“As I’m having ulcers about the price increases, there really are some amazing signs the younger generation is getting much more involved—and staying involved—and enjoying plants. That’s going to keep growing and it’s going to increase our value proposition to the consumer.”

Stephen Weichsel

Business Systems Manager, Knox Horticulture (Winter Garden, Florida)

Stephen responded to one of Bossman Beytes’ weekly newsletters when Chris asked about pricing. At the time in mid-May, Stephen said he was in the process of putting pricing together for 2023. He said they use the same general formula that they’ve used in years past: applying direct costs, allocating indirect costs and then putting a margin on top.

“What I know now is that many of our direct costs are increasing significantly for next season—the second year in a row we’re having double-digit increases on our inputs,” Stephen explained.

He estimated that costs for plug and liner trays are going up 30%-plus, including growing media, which is 30%-plus up year over year (YoY). Knox’s labor cost is about 20% up YoY. And he said that plant input costs are pretty consistently up 5% YoY, “although that can vary based on source and crop/series, and we don’t have quotes in yet from all of our plant input suppliers,” said Stephen.

A significant part of the increases they’re seeing for each part are due to freight, he said.

“Just about two-thirds of all of the plants we ship are delivered on our own trucks,” Stephen said. “Diesel is hovering around $5 to $6 a gallon in most of the delivery radius. Because of the world situation in Ukraine and domestic political priorities, it’s not wise to plan on a decrease in fuel cost for next season.”

Young plant suppliers are different from finished growers, in that they’re not choosing what to produce in a given week or season.

“We’re order takers,” said Stephen. “We publish a list of possible items to the broker companies and they then offer those to customers to choose from. Because there’s that choice from our list, and because we supply customers across the country and can export to most countries in the western hemisphere, we get orders from a wide range of breeders for a particular crop.”

Knox’s pricing is based on one universal category and three variable, core categories:

Universal—The hardlines and labor that go into producing each tray of young plants (the tray cost, media, boxing when necessary, labor both directly applied and indirectly allocated, heating costs, etc.).

“Those costs have seen a huge increase for the 2023 season—30%-plus up for many of them,” said Stephen. “That cost increase to us

has to be included into every tray we produce.”

Variable 1—Plant input cost. This has been averaging a 5% increase to Knox with some exceptions. Since URC quoting is behind this year, Stephen wasn’t sure if that 5% will hold as they get more product in.

Variable 2—Popularity of crops/series/varieties. Larger production runs are easier (thus cheaper) for Knox to produce. “We’re able to price the more popular series lower because of this,” he said.

Variable 3—Difficulty of growing crops/series/varieties. Series/varieties that require a higher buffer will be priced higher than series/varieties that need a lower buffer.

“We track yield over time, so we’re able to accurately forecast the required overstart/overbuy/buffer we need to hit the ordered quantity number each week,” said Stephen. “While we’re not perfect, we do fulfill our grow to orders at ~98%.”

As costs continue to rise, Stephen said another area Knox is using to control costs is culling their product listing. Knox has 37 distinct petunia seed series they can grow, plus seven one-off varieties, and of the 37, they list 11 of them in programs to brokers. Many of those are older series and that’s too many for them to include and maintain the seed inventory in their coolers. Stephen said they can grow any of the other series as a custom sow, with pricing based on the size of the order, but they decided not to maintain the seed inventory for the others.

They started winnowing down their seed plug list last season and will be expanding it to their vegetative liner list for the upcoming season.

“We’re targeting getting our calibrachoa/petunia series list down to 40 or lower for 2023,” Stephen said. “That should help consolidate orders into fewer series, meaning bigger URC orders from individual stock farms for listed series. It should help.”

Dave Holley

General Manager, Moss Greenhouses (Jerome, Idaho)

“Pricing will be key for the foreseeable future,” said Dave, who presented a pricing class at the Idaho Nursery Landscape Association Trade Show in January and will be presenting an online pricing class during Cultivate, which will address the different types of pricing options for retailers.

“It is always amazing to me how many retailers (and possibly some smaller wholesalers that don’t know their numbers) who will give something away or match prices with another retailer/

grower because they fear taking price increases,” he said.

Here are Dave’s key points to know to be successful:

1. Know what your costs are in both direct and indirect costs.

2. Based on those costs, develop your budget. What margin do you need to have to be successful? A successful retailer needs to be in the 42% to 44% gross margin range if they want to stay in business.

3. Now more than ever you need to buy early. For Moss, all of 2023 has already been purchased—Dave said they’ve already ordered roughly half of what they need for 2024 and already have an order on the books for 2025.

4. Look where your “pinch points” are in both production, movement and labor (Moss’ pinch point is in labor) in order to have more efficiencies. Leaving things in the status quo is no longer an option. They increased production runs and standardized plug trays, each size tray for a particular finished size.

5. Look at what’s selling—not from your heart, but with hard data. What would you like to sell (is there a need in your marketplace) and what do you want to give up to make that happen? Dave said Moss increased production of Proven Winners with the perceived notion that some growers in their region were dropping the program with the new container requirements.

6. Control your costs. This is hard in today’s supply chain. Before Moss received some of their containers this past season, they had two price increases from the vendor after budgeting for success at lower costs half a year earlier.

Labor costs in their region are up 35%. Dave said he budgeted what he thought was a healthy 15%. (Now with the increase in hourly wages to compete in their marketplace, Dave said he’s not necessarily getting better employees to do the job that needs to be done.)

Fuel prices are up 57% over this time last year. Dave said he budgeted for 10%. And container costs announced (at least what the vendors are willing to quote for 2023) are up another 12% on top of the 10% to 12% last year.

“My vendors are like the rest of us, as one said they thought they would drive away business with a 25% increase. Now, they cannot even guarantee shipment,” said Dave.

Dave said when everything was said and done, he presented Moss Greenhouses ownership with a picture of pricing that covered every container they grow with increases ranging from 2% to 37% (for upscale decorative containers).

“We decided on a single price increase across the board, which was based roughly on the average increase we needed to take,” he explained.

He said that their customers understood the need for the increase until they were forced to take a fuel surcharge in April on rising fuel costs.

“We held off as long as we could and you can imagine the comments received,” he admitted.

For 2023, Dave said he and his team will take a hard look at pricing and they’re already developing spreadsheets with the latest pricing as they get it in.

“But I can’t see a scenario as it stands right now where we don’t take our price up anything less than 6% for 2023,” said Dave.

Andy Ambrosio

Director of Sales & Finance, Wenke/Sunbelt Greenhouses (Kalamazoo, Michigan)

Wenke and Sunbelt base their pricing on the size and cost of the container, as well as plant costing and average grow times for the item. Similar to everyone we’ve spoken to—for this story and others—they raised their prices this year.

“Generally speaking, what we did we thought was fair and appropriate,” explained Andy. “It was in line with what [our customers] saw from most other people.”

Andy said the only pushback they saw was about the fuel surcharge they had to implement in February because of skyrocketing costs on diesel. It was the first time in 12 years that Wenke had to include a fuel surcharge, but “there’s not a lot of ways you can skin that cat,” he said.

There were some areas where the Wenke team was able to pivot in order to try and save some money. Andy said that this past year, knowing that plastic costs were going up—especially on colored pots—they switched some varieties over to a plain black pot.

On the flipside of that, they’re also always looking for ways to extend or better communicate a higher perceived value for certain products. Wenke produces a tray of different tomato varieties and this year they included a flat-talker with care information and tips for home gardeners.

Wenke/Sunbelt participates in the H-2A program, so though they were able to find enough labor, the Adverse Effect Wage that the U.S. Department of Labor dictates went up significantly. Sometimes the first reaction to the lack of labor is to add more automation, which can really save your bacon during peak, but just as important are your systems. This year, Wenke invested in new software that helps them to take and track orders more efficiently, pull orders faster, and generally be more accurate with inventory across the board.

As for next year, Andy laughs and says he doesn’t do predictions because he’s always wrong. But he does think the peat moss shortage (which is mostly affected by the weather and increased demand) will have a huge impact. Also, although he feels like trucking seems to have stabilized a bit, the price of fuel will still continue to affect freight costs.

“So do you keep a fuel surcharge in play or do you raise your prices on product?” asked Andy. “Either way, you have to capture that cost. So my prediction for 2023 is that there are still price increases coming.” GT