6/1/2019

Pricing: Think Beyond the Loaded Truck

Dr. Charlie Hall

Recent changes in the management and buying structure at some of America’s big box stores provide an opportunity to re-visit how these retailers have impacted pricing strategies in our industry. But even if you’re not selling to box stores or selling in a pay-by-scan environment, it pays to think beyond the truck being loaded to how retail pricing and merchandising affects your profitability.

How PBS works

When Home Depot first launched its pay-by-scan (PBS) program in 2005, there were mixed reactions by growers as to how they were going to be impacted by this new vendor-managed inventory strategy. As with most disruptive innovations, some gained while some lost … some a little, others a lot.

What exactly is pay-by-scan? In short, it’s a distribution system that allows live-goods suppliers to allocate inventory into retail stores, maintain the product themselves and replenish as needed. Ownership of the product doesn’t transfer until the customer actually purchases the plant. Once the product is scanned at the register, an invoice is created and growers are compensated based on their negotiated payment terms.

PBS is a selling system that requires high levels of merchandising services to be successful. Come to think of it, that’s true regardless of whether the grower is selling into a “true” PBS situation or not (e.g., Walmart’s Train & Assist Program [TAP]). Nevertheless, suppliers are completely responsible for the condition of the inventory and how the program gets displayed and maintained at store level. Thus, these merchandising services, provided as a benefit to the retailer, are (or should be) built into costing.

Incorporating the retail mindset

One of the main reasons that some growers haven’t done so well transitioning to this type of retail environment is because they miscalculated what their true costs were going to be, therefore their invoice price was too low, and it took several years for them to dig themselves out of it. It also put pressure on the growers who were doing their retail cost accounting correctly to have to lower their invoice pricing.

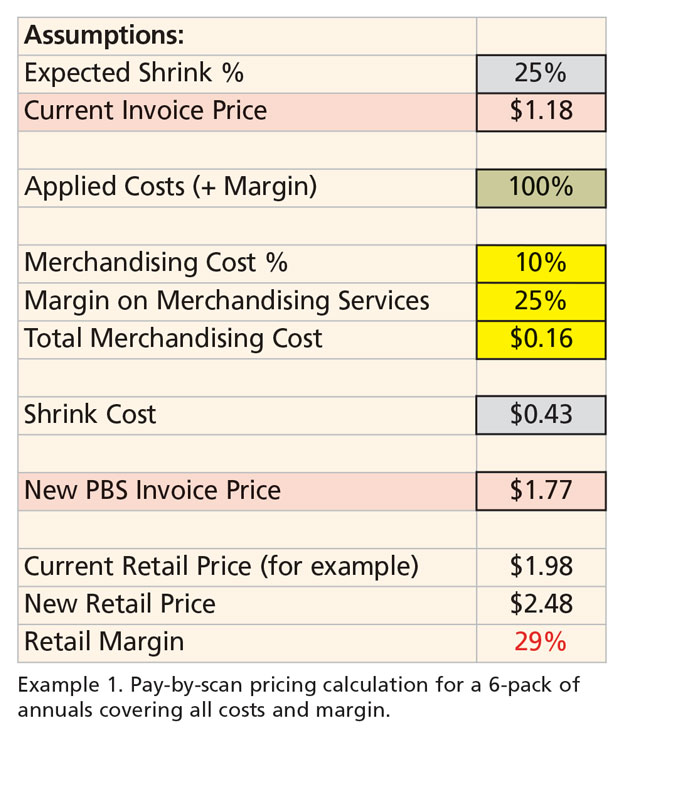

If you’re thinking about quoting any PBS business, I’ve created a quick example in Excel that demonstrates what I’m talking about (Example 1).

In this example, let’s use a standard 6-pack of annuals. The grower has calculated their costs and negotiated an invoice price of $1.18 for this 6-pack. Let’s also assume for the moment that this correctly includes all of the grower’s applied costs and their desired profit margin.

The mindset of some growers when they first entered into the PBS arena back in the early days was: “Well, my shrink is usually 25% at retail, so I’ll multiple my invoice price by 25% and that will cover me.” Using this mindset, the invoice price in this example would be around $1.48. It sounded good, but in reality, they didn’t cover all of their true costs and they ended up leaving a lot of money on the table.

For example, growers also needed to cover the cost of merchandising services they were providing in support of the retail lawn and garden area/plan-o-gram they were responsible for. Assuming conservatively that their merchandising costs were 10% of invoice price, then invoice price should be adjusted accordingly.

But that’s not all—since those services are a part of the value proposition being provided by the grower, it makes sense that they should also include a profit margin on those services provided. Assuming a conservative 25% margin (I just used a typical production-level operating profit margin for example purposes), then this means that a total of $0.16 should also be added to the original invoice price in order to cover the cost of providing the merchandising services and a reasonable profit margin on those services.

But we’re not done: We haven’t accounted for shrink yet and here’s where the mindset of the grower has to shift somewhat. Instead of looking at shrink from a production standpoint and thinking in terms of units lost, growers now need to think of shrink in terms of dollars. So dollars shipped divided by the retail dollars generated gives you the retail shrink incurred.

Ca lculating the cost of the assumed 25% shrink on the items lost, as well as spreading the merchandising cost over the remaining units, means that an additional $0.43 needs to be added to the invoice price. In other words, to maintain current margin after shrink, the price needs to increase by another 36.7%.

lculating the cost of the assumed 25% shrink on the items lost, as well as spreading the merchandising cost over the remaining units, means that an additional $0.43 needs to be added to the invoice price. In other words, to maintain current margin after shrink, the price needs to increase by another 36.7%.

Here’s an important point: I didn’t arrive at the $0.43 by simply multiplying 25% by the invoice price (1.25 x $1.18); that would have been a markup mindset. Remember, we’re talking about percentages of shrink of retail dollars, which means we need to think of it in terms of a margin mindset. A 25% markup is the same as a 33% margin [1/(1-.25)-1], which is what I use to multiply times the original invoice price. Then on top of that, I allocate the same 33% of the merchandising costs to arrive at $0.43 ($1.18 x 0.33 x 1.10).

So, if we add all of this together, accounting for both the costs of shrink and the cost of the merchandising services provided, our new invoice price should have been $1.77 per 6-pack, not the $1.48 assumed earlier. That’s a 50% increase over the old invoice price, not just 25% that some growers assumed would have been enough! To keep retail margins at 30%, then a new retail price should be set at $2.48.

In negotiating invoice prices, remember I said that invoice prices should include three things: 1) All applied per-unit costs incurred during production and the profit margin on those units; 2) the true costs of shrink that occurs at retail; and 3) the costs and margins associated with the merchandising services provided.

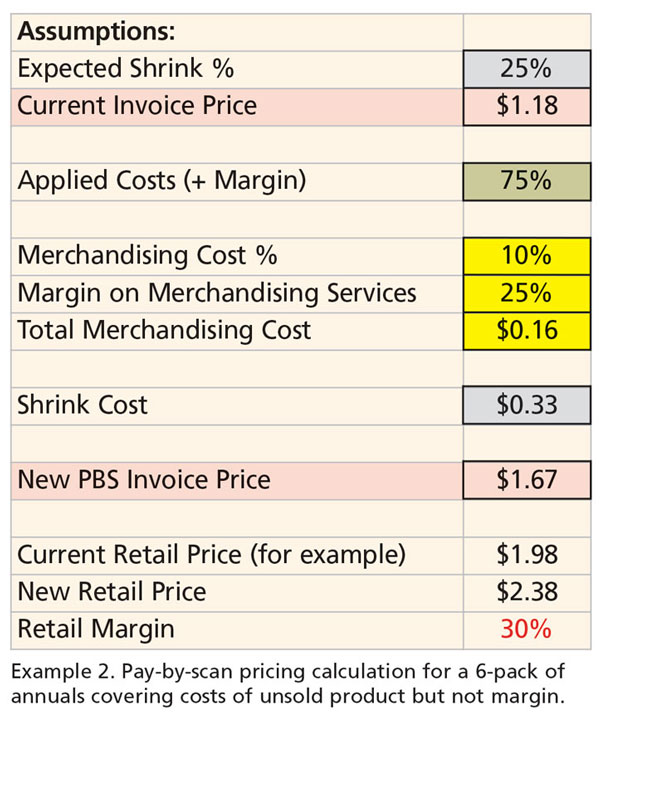

What if the box store buyer mandates that you can’t charge a profit margin on unsold product, but only cover the cost of those units? In economic terms, it’s an opportunity cost, in that you lose out on the opportunity to earn a profit on those unsold items. Since I included the box in the spreadsheet showing the cost and margin allocation, I can back it down from 100% to, let’s say 75%, to demonstrate how this affects the situation.

As you can see in Example 2, this has the effect of lowering the invoice price to $1.68 and the retail price can decrease to $2.38 to maintain the 30% retail margin.

Needless to say, negotiating with box store buyers is an important skillset, but going into those negotiations knowing your true costs of production, your true retail shrink-related costs and your true retail merchandising costs is equally important.

A final note: Even if you’re not selling to box stores, the lesson here is to consider the mindset of IGC and landscape customers, and the effects of shrink and merchandising costs on retail margins. If you can provide services and/or superior plant quality that helps to reduce retail shrink or enhance your customer’s ability to sell those plants to end consumers, then that added value is worth something to your customer. You might use this to influence negotiated FOB prices, as well.

Of course, knowing costs of production is a requisite piece of knowledge because total costs serve as the pricing floor (the level you should never go below).

The Theoretical Side of Pay-By-Scan

In theory, growers selling into a PBS environment should have more influence over the product mix in the retail displays and what gets advertised; they should have a lot more input regarding final retail pricing. They could almost script their own season by being proactive in participating in or writing their own local market ads and hence the surprises that box store buyers have sprung on growers in the past would be reduced.

The reality today is that the retailer still dictates many of these things.

The Benefits of PBS (when done correctly)

• Growers have the opportunity to be the sole source of supply for their category. In fact, one could argue that the PBS system only works when this is the case. In other words, there cannot be multiple vendors shipping the same product into the store at the same time. It causes too many logistical issues.

• Growers are able to better control or manage the level of inventory going into the store. They can put in the products they deem appropriate in the quantities that they feel are adequate to meet consumer demand.

• Growers can push products into stores based on “what looks best in inventory” and drive consumer demand accordingly. They can also put as much or as little as they deem appropriate, providing it meets with their regional buyer’s directives. It basically gives growers a much bigger voice in their own destiny.

The Challenges of PBS

• In a traditional purchase-order system, the risk is more evenly shared between the grower and retailer. However, in a PBS situation, most risk is transferred from the retail merchant to the grower. That means all risks associated with theft, damage, mis-scans, lack of water, freezing, etc. are solely the responsibility of the grower. Growers should be compensated for that risk, but this is often contrary to the mindset of most buyers in the highly competitive box store environment.

• Since most growers are borrowing on receivables, there can be a constraint on working capital because there’s a receivables lag with PBS. This may also impact the willingness of a grower to take on any more financial risk and it may also affect the ability of the grower to have cash flow growth of the business devoted to that particular retailer.

• Shoulder seasons must be managed well by the grower. Depending on location, this could be one of the biggest risks a grower faces. There’s constant pressure from buyers to load up the stores before the season is truly ready; conversely, growers must be cautious not to over-produce for the later part of the season and overfill stores on the back side of the shoulder.

• It’s already difficult to find enough labor to fill jobs at the production level, but now growers must staff a merchandising company or incur the rising costs of third-party merchandising. GT

Dr. Charlie Hall is a Professor and holder of the Ellison Chair in International Floriculture at Texas A&M University.