6/1/2019

Marvin Crunches the Census of Ag

Chris Beytes

The U.S. Department of Agriculture finally released the 2017 Census of Agriculture, the result of a mandatory survey conducted every five years in all 50 states for all agricultural producers. Dr. Marvin Miller, “Hortistician” for Ball Horticultural Company, says the 2017 report has “both some surprises and some expected results.” He was generous enough to share his initial findings with us:

First, when compared to the 2012 Census, the total number of farms in the U.S. was down 3.2% to 2,042,220 farms, with 2017 sales reported down 1.6% to $388.5 billion. Average income per farm was up 1.7% over the five-year period, to $190,245.

For the nursery, greenhouse, floriculture and sod sector, the total number of farms was off 11.0% to 46,970 operations in 2017 from the 52,751 reported in 2012. However, sales were up 11.4% to $16.2 billion in 2017 compared to $14.5 billion in 2012.

Narrowing the scope further to what we call floriculture (cut flowers, potted flowering plants, foliage plants and bedding/garden plants), there were 5.6% fewer operations (25,370 in 2017 compared to 26,884 firms in 2012), but sales increased a total of 5.2% over the five-year period to $6.19 billion. In contrast, nursery crop producers were down in number, off 20.5% to 16,420 firms from 2012’s 20,650 firms, while sales increased 15.4% to $5.89 billion. (Note: floriculture is still bigger than nursery crops.)

Sales of plant propagative materials have been segregated. Sales of cuttings, seedlings, liners and plugs increased 10.1% over the five-year period to $644.4 million for 2017, with 1,992 operations participating in 2017 sales, an increase of 32.0% in firm numbers over 2012.

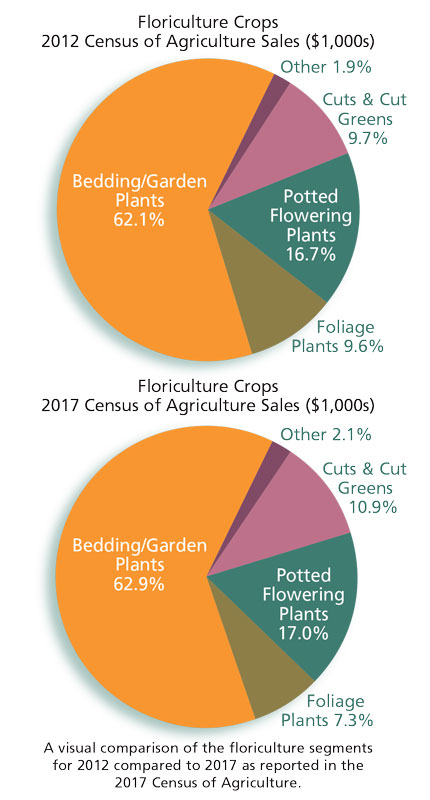

Getting down to our floriculture segments yielded some surprises:

• Bedding/garden plants—Operations down 8.0% in number to 16,241 firms in 2017. Sales increased a total of 6.5% over the five-year period to $3.894 billion in 2017.

• Potted flowering plants—Firm numbers increased 7.7% to 5,837 operations in 2017, while sales increased 6.7% to $1.050 billion for 2017. Based on previous trends and what I’ve seen in the marketplace, I would say I am surprised on both counts here.

• Foliage plants—Firm numbers up 16.8% for 2017 to 3,142 operations. Surprisingly, reported sales were off a dramatic 20.3% to $449.2 million for 2017. Looking at the data, it appears that Hurricane Irma had a huge impact on reported 2017 sales in the Sunshine State, as Florida, which often accounts for over two-thirds of nationwide foliage plant production and sales, barely accounted for half (50.1%) of the 2017 sales tally.

• Cut flowers and cut florist greens—Firm numbers up 15.2% to 6,768 operations for 2017. Sales up 17.8% to 672.0 million for 2017.

• Other floriculture crops—Firm numbers down 17.2% to 1,513 operations for 2017. Sales up 11.2% to $127.1 million for 2017. GT