9/30/2025

Review & Re-evaluate

Traci Dooley

There’s a saying that the only constant is change. That’s probably true for most operations, including yours, as you head into the final months of 2025. Maybe you’ve added staff, upgraded systems or expanded production. Maybe you’re planning new investments for next season. With these moves, your risks—and therefore insurance needs—likely have shifted.

For growers with January 1 insurance renewals, October marks the start of a crucial 90-day planning window. It’s an opportunity to talk with your insurance provider about adjusting coverage to the value of your current operation, to take control where you can in a fluctuating economy and to create certainty for where you’re headed.

The greenhouse industry increasingly relies on specialized growing technology and tightly linked production processes, and your insurance should match that complexity. A proactive review now means you’ll be covered when it matters, whether that’s protecting new equipment, accommodating expanded services or ensuring adequate business interruption coverage for today’s longer rebuilding timelines.

The process doesn’t have to be overwhelming. With the right approach, you can systematically evaluate what’s changed, identify gaps and build insurance coverage that serves your business strategy.

Step 1: Review the past year and contemplate the one ahead

Before you renew, gather your team to identify all the changes in your business in the past months. Even small updates can have insurance implications. Use this checklist as a starting point:

- Employees: Have you added or reduced staff, or increased payroll? Which staff classifications do you have? Changes in staff numbers and jobs will affect your workers’ compensation coverage.

- Property: Did you construct, update or remove any buildings or greenhouses? Have you added controlled environment systems or upgraded climate controls?

- New equipment: From benching systems to irrigation pipes to boilers, are there new or replaced machinery that should be covered?

- Moves: Did you expand, downsize or relocate operations? Your geographic risk profile can change significantly.

- Services: Have you added delivery? This feature might require new or expanded commercial auto coverage.

- Vehicles: Any changes in fleet size or how often vehicles are used for business? More mileage or new drivers may shift your auto insurance needs.

- Contracts: Remember that new subcontractors or rental agreements may come with specific insurance requirements.

Don’t forget to think ahead. If you’re considering modifications to your business with investments in vertical farming, expanded e-commerce offerings or changed suppliers, your coverages can all be impacted. It’s better to start planning appropriate coverages now—and asking your provider questions—rather than being caught off guard later.

Step 2: Adjust to the new normal—Increased inflation and longer, more expensive rebuilds

Inflation has impacted nearly everything vital to this industry—materials, equipment and labor. If your business invested in more stock than prior years to avoid inflationary pressures, consider whether your inventory values need to be adjusted.

If disaster strikes and your coverage is based on what your property was worth even three years ago, your policy could fall short just when you need it most. Talk to your provider about adjusting coverage to match current rebuilding and replacement costs. And discuss expanding your coverage beyond structures to include equipment, systems and even inventory.

Business interruption insurance is an equally important topic to discuss. It’s the safety net that keeps payroll running and operations afloat if you’re forced to shut down due to a covered loss. In the past, six months of coverage was the industry standard. Today, with widespread delays in permitting, material shortages and longer overall job completion times, 12 to 18 months of coverage is often more realistic. Think of it like disability insurance for your business.

Step 3: Build resilience and remove doubt through optional coverages

Modern horticultural businesses are more complex than ever and your insurance needs to reflect that. Here are some types of increasingly essential coverage:

- Cyber liability: Digital records, online sales and connected systems mean new vulnerabilities. Cyberattacks and data breaches aren’t just an IT problem—they’re a business continuity issue.

- Employment practices liability insurance (EPLI): As hiring practices evolve and legal risks increase, EPLI provides crucial protection against discrimination, harassment and wrongful termination claims.

- Commercial auto: If you’ve added delivery or expanded your service area, make sure your policy accounts for it, especially if you’ve added drivers or updated your fleet.

- Errors and omissions (professional liability insurance): If you provide design services or advice—like landscaping recommendations or pest control programs—this policy type protects against unintended consequences of your expertise.

Step 4: Examine deductibles and consider cash flow

Before renewing your insurance policy, it’s important to examine deductibles, which should be aligned with your risk tolerance and cash flow. While a higher deductible can lower your premium, ask yourself whether your business could withstand that deductible if a loss occurred next week. To protect operations, businesses that choose higher deductibles should also plan for and have at least that much on hand at all times.

Step 5: Account for specialty systems and techniques

As controlled environment agriculture becomes more common, new technologies bring new risks. Whether you operate a hydroponic greenhouse, a vertical farm or a hybrid system, your insurance provider should understand the specialized infrastructure and interdependencies of your growing environment.

Systems like aeroponics or aquaponics rely on sensitive equipment and tight environmental control. A mechanical failure or power outage in these systems can have a ripple effect across your entire operation. Make sure to work with your insurance provider so your policy reflects that complexity.

Step 6: Reinforce your operation’s culture of safety

No matter how thorough your insurance plan is, prevention is always your best protection. Be sure to prioritize:

- Routine maintenance schedules for equipment

- Regular safety meetings and employee training

- Proactive planning for seasonal risks (wildfires, hurricanes, freeze events)

A safer workplace not only protects your people—it can reduce claims and improve your risk profile with insurers.

Step 7: Know what to look for in a provider

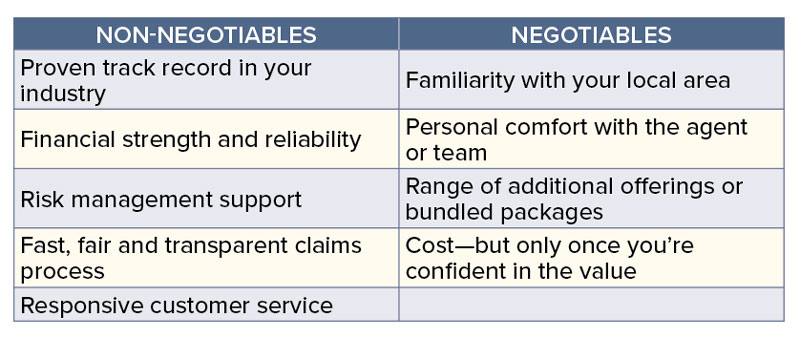

When it comes to choosing an insurance partner, the right fit matters. Here’s a snapshot of the must-haves versus the nice-to-haves:

Non-negotiables:

- Proven track record in your industry

- Financial strength and reliability

- Risk management support

- Fast, fair and transparent claims process

- Responsive customer service

Negotiables:

- Familiarity with your local area

- Personal comfort with the agent or team

- Range of additional offerings or bundled packages

- Cost—but only once you’re confident in the value

Growers are innovators. Your operation isn’t the same as it was last year and your insurance shouldn’t be either. With today’s rising production costs and ever-changing risks, now is the time to be proactive.

Growers are innovators. Your operation isn’t the same as it was last year and your insurance shouldn’t be either. With today’s rising production costs and ever-changing risks, now is the time to be proactive.

Don’t wait until renewal paperwork lands in your inbox. Start the conversation now. Use this season to reflect, re-evaluate and rebuild your policy with intention so that whatever next year brings, your coverage is ready. GT

Traci Dooley is national agency sales director for Hortica, a brand of the Sentry Insurance Group.