10/1/2024

What We Can Learn from Proven Winners’ Customers

Chris Beytes

In Proven Winners’ 2024 Consumer Data Report, the plant introduction company asked some basic questions about where consumers bought their Proven Winners plants; whether they chose annuals, perennials or something else; and what factors influenced their purchase decisions. They also asked about challenges consumers face when gardening, from weather to mobility issues and more.

This month, we look at where they shop and what they shop for. We also learn what’s happening with a crop Proven Winners introduced back in 2018, but that you may not have seen lately. Here’s the data, with analysis by your author with the help of Kevin Hurd, Proven Winners’ VP of product development.

In July, Proven Winners surveyed 10,933 gardeners in their email database and asked these two questions:

Where do you shop for Proven Winners plants? Choose all that apply.

77% Independent Garden Center

57% Big box store

24% Online

6% Grocery store

4% Other

The first thing I noted was the online number: 24%. That seems high for online plant shopping, even in this day and age of daily Amazon deliveries. I wondered if it was because the names in the database come, at least in part, from folks who’ve shopped online at provenwinners.com. I was also interested to see that IGCs were a bit more popular with respondents than the big boxes. I asked Kevin about both numbers.

The first thing I noted was the online number: 24%. That seems high for online plant shopping, even in this day and age of daily Amazon deliveries. I wondered if it was because the names in the database come, at least in part, from folks who’ve shopped online at provenwinners.com. I was also interested to see that IGCs were a bit more popular with respondents than the big boxes. I asked Kevin about both numbers.

“Obviously, this [survey] is specific to Proven Winners and the independent garden centers align with where we’re traditionally selling the most,” he answered. “The big boxes are a little bit lower.”

As for the online number, Kevin admits, “Remember, it is an online survey, but 20 years ago less than 2% answered that they had purchased a plant online.”

Question two explains more about that online sales figure:

Do you wish the garden center(s) where you shop for plants carried a wider selection of specific Proven Winners varieties?

86% Yes

That means more than four out of five gardeners aren’t happy with the selection they can find at their local retailer— another seemingly high number. What is it they’re looking for that they can’t find? Kevin interprets it this way: Consumers want the newest of the new, but some retailers aren’t offering them or can’t get them from their local source.

“One of the biggest things we see is that our sales of liners to wholesale and retail growers does not align with our sales of new products online. Our newest-of-the-new are consistently up in the top 20% to 25% sold online. Those don’t rank nearly that high when we look at our liner sales.”

In other words, consumers are embracing the newest offerings, while growers and retailers are a bit slow to offer them. He adds that this challenge of adopting new varieties isn’t exclusive to Proven Winners; it’s industry wide. We often admire a new offering at CAST, for instance, but then question whether or not it’ll make it into any plug producer or rooting station’s list.

“You do what you did last year, right? Versus really diving into what’s new,” Kevin said.

Space, too, is a challenge. To grow something new, you may have to drop something old. But what to drop? Or do you add space?

But there is help available! Kevin said Proven Winners has the sales data to assist growers and retailers with making smart decisions about how much of any particular item to grow.

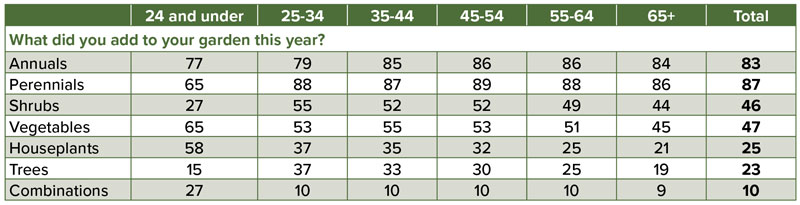

In August, 7,469 gardeners in the Proven Winners database provided more detail about their plant-shopping habits.

What types of plants did you add to your garden this year? (Select all that apply.)

*These numbers are percentages.

The main thing I note is that young people bought the most vegetables (65%) and houseplants (58%). And they’re pretty high consumers (77%) of annuals. That’s interesting and of value to know. But they don’t buy as many trees and shrubs—that must be because many don’t yet have a yard of their own.

The main thing I note is that young people bought the most vegetables (65%) and houseplants (58%). And they’re pretty high consumers (77%) of annuals. That’s interesting and of value to know. But they don’t buy as many trees and shrubs—that must be because many don’t yet have a yard of their own.

I also note that houseplant purchases peak young at 58%, but taper down to about 25% as gardeners age. So it seems we should be aiming our houseplant sales at young consumers.

Trees and shrubs, meanwhile, have a peak purchase age between 25 to 54 (prime home acquisition age), while annuals and perennials seem timeless, ratcheting upward a bit at ages 25 to 35, then staying there. Kevin agreed completely with my analysis.

“Yeah, we’ve always looked at houseplants and vegetables as gateway plants,” he said. “Even when I look at my own friends, when they finally did start to garden, they bought the vegetables first and they bought houseplants first. As they got further along in their careers, they bought homes, and then they transitioned to annuals, shrubs and trees. It really comes down to homeownership. That’s really the big key.”

I asked Kevin if this demographic data was behind their addition of houseplants via the leafjoy brand.

“Truthfully, our strategy is, we want to be a garden brand and those plants are a part of that,” he answered. “We’ve been looking to get into houseplants for a while.”

Mention of vegetables reminded me of Proven Winners Proven Harvest vegetable line, introduced in 2018 with Garden Gems and Garden Treasures tomatoes and Amazel Basil. But I had to admit, I hadn’t heard about Proven Harvest recently. I asked Kevin for an update.

Mention of vegetables reminded me of Proven Winners Proven Harvest vegetable line, introduced in 2018 with Garden Gems and Garden Treasures tomatoes and Amazel Basil. But I had to admit, I hadn’t heard about Proven Harvest recently. I asked Kevin for an update.

“After COVID, we mothballed that program,” he admitted. “You can buy some of the varieties online, but we’ve pulled back for right now. But we are working on something. We’re retooling it.”

While he couldn’t provide more details, he hinted that the relaunch would include a partner grower—along the lines of Walters Gardens for perennials, Spring Meadow for flowering shrubs and The Plant Company for foliage.

“We think that that’s a better strategy going forward … We are looking to bring some new vegetables and herbs to the market, and we’ve decided that the best way to do that is to find an expert.”

And while Kevin wouldn’t divulge a timeline, he did say it would be an announcement very much like their previous licensee announcements.

Next time: The survey respondents reveal where they gardened, why they chose the plants they did and what challenges they face as gardeners—from weather to mobility. And we reveal a crop new to the Proven Winners lineup. GT