6/1/2023

The State of the Horticultural Automation Sector

Dr. Alexandra Grygorczyk

The idea of automation in the horticultural industry was new just a few short years ago. Today, there’s a tidal wave of novel technologies coming to market, promising to automate tasks, including harvesting, pollinating, sorting, climate control, disease and pest scouting, and irrigation, among others. This continuous influx makes it difficult to keep up. However, getting where we are today has required resilience from both automation companies developing the technologies and growers who trial and adopt them.

As the horticultural automation sector matures, Vineland Research and Innovation Centre has taken a step back and evaluated the state of the industry—its challenges, opportunities and where it’s heading.

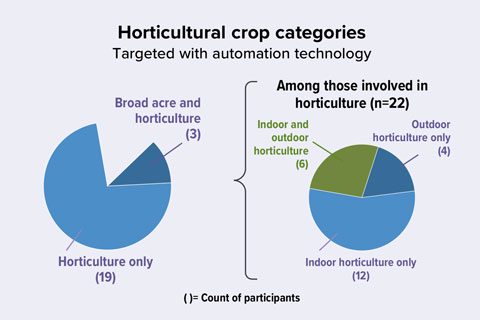

In early 2023, Vineland’s Consumer, Sensory and Market Insights team conducted interviews with 26 different organizations involved in horticultural automation and asked open-ended questions about the companies’ experiences in entering the horticultural space and what they see in the coming years. These interviews comprised 22 automation companies, three consultants or government horticultural specialists and one academic researcher. The interviewed organizations were spread across the globe with representation from Canada (10), the Netherlands (9), the United States (3), Japan (2), Israel (1) and Singapore (1). Twenty-two of these organizations were involved with automation for the horticultural industry, including 12 focused on indoor production, four on outdoor production and six working in both environments. The remaining four automation companies weren’t currently developing technologies for horticulture, but were actively evaluating whether or not to enter that space.

The challenges

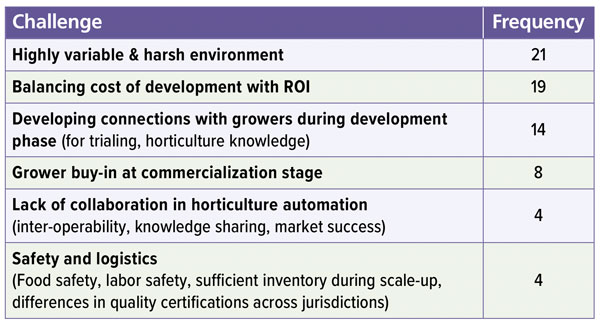

Feedback centered around the challenges of developing and commercializing technologies successfully for the sector. The top two most cited challenges were the highly variable and harsh environment, and balancing the cost of development with a return on investment for businesses and growers.

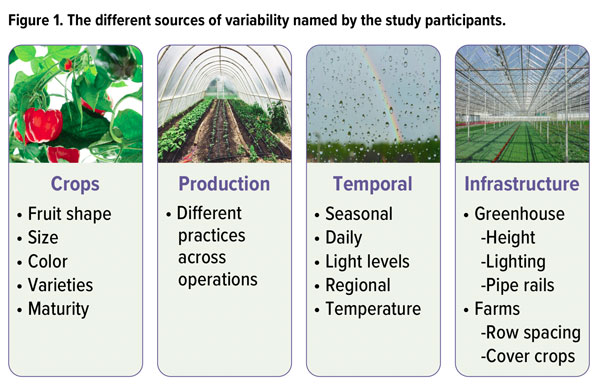

Horticulture doesn’t have the product or environment uniformity of heavy industries like automotive or manufacturing. As a result, the extent of variability and the associated difficulty to automate were often underestimated by companies when first entering the sector.

Automation systems generally rely on vision systems (i.e., cameras) or sensors to feed data to artificial intelligence (AI) systems. These AI programs guide internal decision making, such as when an autonomous robot should move forward or stop, or which combination of colors and shapes determines when an automated scouting system should report that disease is present. However, variable conditions, including a cloudy or sunny day, will change how shapes and colors look. Thus, photos or videos are used to “train” the AI. The more variability there is, the more photos and videos are required to capture the many different scenarios that exist.

Another issue complicating matters is that growers use different production practices for the same crop, making it difficult for automation companies to determine which growing practices to focus on and which growers to work with for trials. One participant indicated they had a great trial relationship with a particular grower, but when it came to the commercialization phase, it turned out that grower had been using production practices not frequently used by the sector. As a result, the automation company had to invest in additional development to adapt their system to more common production practices. Choosing trialing partners may be risky for companies since there are few publicly available resources describing the adoption rates for different production practices by crop type.

Another issue complicating matters is that growers use different production practices for the same crop, making it difficult for automation companies to determine which growing practices to focus on and which growers to work with for trials. One participant indicated they had a great trial relationship with a particular grower, but when it came to the commercialization phase, it turned out that grower had been using production practices not frequently used by the sector. As a result, the automation company had to invest in additional development to adapt their system to more common production practices. Choosing trialing partners may be risky for companies since there are few publicly available resources describing the adoption rates for different production practices by crop type.

As shown in Figure 1, farm operations have many sources of variability. All of these feed into the cost of developing automation technologies, the second most cited challenge. The intrinsic diversity of growing horticultural crops means big data is required to train AI systems, which can become time-consuming and costly.

For instance, there are labor costs associated with collecting the data, developing systems for data management and completing iterations of the system to increase reliability, as well as the actual cost of data storage. Automation companies must also select robust electronics and hardware to protect against dust, moisture or rain, and potential physical hazards (i.e. getting knocked over by a passing worker) on site. Ultimately, there needs to be a balance between final cost of development for the company and an attractive return on investment for growers.

For instance, there are labor costs associated with collecting the data, developing systems for data management and completing iterations of the system to increase reliability, as well as the actual cost of data storage. Automation companies must also select robust electronics and hardware to protect against dust, moisture or rain, and potential physical hazards (i.e. getting knocked over by a passing worker) on site. Ultimately, there needs to be a balance between final cost of development for the company and an attractive return on investment for growers.

Building trust through trials

Although the horticultural industry is quite large, it’s still very much a niche market, as the varied range and varieties of crops often need tailored automation solutions. One key element of success is being able to spot the application requiring relatively low efforts for development with high enough utility to growers to be a worthwhile investment.

The development of grower relationships both at the trialing and commercialization stages were the next most cited challenges for automation companies. The ideal trial partner is a grower who uses common production practices, is committed to data collection, is open to automation system iterations and can provide good two-way communication. This wish list is onerous for growers whose time and resources are often already stretched thin. Furthermore, many growers have already invested significant time on failed technologies and have become cautious in building new collaborations with companies.

It's important, however, to understand why a grower would decide to participate in trials. Many benefits exist, including being the first to market with a new solution, owning an automation solution customized to your crop and growing operation, and having a direct line of communication for technical support. On the other hand, automation companies require access to realistic trialing spaces, as well as dedicated grower participation to support the development of new technologies.

One solution is to establish pre-commercial trialing spaces with farm infrastructure and crops grown to industry standards with researchers’ support for data collection and system validation. Vineland’s Automation team is working with technology companies to test and validate the performance of their systems directly on our research farms and greenhouses using the expertise of Vineland’s staff in engineering, agronomy, market intelligence and others.

Our researchers develop testing protocols and verify the performance of innovative technologies to accelerate their launch in domestic and international markets.

The high-level screen and technology verification provide information for end-users to make an informed decision regarding technical and economic feasibility of the technology concept for their farms and give feedback to automation companies on where to focus their development efforts. Similar testing facilities are needed in different jurisdictions, as growers need to see systems actually working in their local area to build trust.

Helping the horticultural sector adapt to automation rather than placing the burden solely on the automation sector to adapt to horticulture is another way to increase collaboration. An opportunity exists to breed plant varieties more compatible with automation.

One example is crop architecture that makes robotic harvesting easier by leaving the target cutting area more exposed and less obscured by foliage. Another example is the development of standards for greenhouse design and farm practices, such as standardized row spacing to make rows more amenable to automation. Standardization will reduce development costs, improve the reliability of automation systems, and ultimately, benefit both parties.

Automation technologies may not yet be ubiquitous in the horticultural industry since many systems still have technical hurdles to overcome to appeal to mass markets. However, the technology is rapidly advancing and automation hardware, such as sensors, have seen significant price drops in the past few years, making the technology more affordable. By working together, growers, research institutions and automation companies can help overcome those hurdles more quickly and facilitate the entry of automation into the horticultural sector.

Automation technology is a key part of the solution in resolving challenges faced by the horticultural sector including labor shortages, profitability margins and sustainability goals. As an increasing number of automation companies are gaining experience in the horticultural sector, the industry is gradually evolving and companies are learning to work within the constraints of living crops and dynamic farm environments more effectively.

It’s necessary for growers to continue maintaining their openness to new technologies, understanding that the immense challenge of automating horticulture requires many iterations, patience and the understanding that reliability will never start at 100%. Growers and automation companies need to collaborate to help integrate automation into the horticultural sector using a phased approach that blends labor support with realistic automation goals. These automation goals need to balance the cost of development with utility and system reliability.

With growers’ support, the reliability of these systems will improve, and as the anticipated labor shortages increase, automation technologies will be ready to help farm businesses thrive. GT

This research was completed under the Canadian Agricultural Partnership supported by Agriculture and Agri-Food Canada. If you’d like to learn more about the study or Vineland’s services, email info@vinelandresearch.com or visit vinelandresearch.com.

Dr. Alexandra Grygorczyk is a Research Scientist, Sensory & Consumer Services, for the Vineland Research and Innovation Centre.