1/1/2022

Houseplant Purchasing Trends

Julie Martens Forney

Houseplant hysteria. Houseplant hype. Houseplant craze. In the last year, the media has coined these phrases to describe the boom in green plant sales. Just about every retail outlet has gotten in on the sales action, from supermarkets to home centers to online influencers. People want plants in their homes and they’re looking to buy.

In an effort to quantify the why behind consumer houseplant purchases and other marketplace trends, the Floral Marketing Fund conducted an in-depth study. Five industry organizations stepped up to co-sponsor the research: Altman Plants, Costa Farms, Green Circle Growers, Hortica and Metrolina Greenhouses. The results showcase opportunities for growers and garden center owners to increase houseplant sales. Get ready to understand the houseplant frenzy—and a few options you can use to grab some of the profits.

State of the houseplant market

Houseplant sales are booming—and are predicted to keep growing. The market outlook is strong and consumers of all ages are eager to bring green goods home. Dr. Hayk Khachatryan is Associate Professor and Director of the Consumer Behavior & Insights Lab in the Food and Resource Economics Department at the University of Florida. Working with Dr. Melinda Knuth, Department of Horticultural Science, North Carolina State University; and Dr. Charlie Hall, Department of Horticultural Sciences, Texas A&M University, Hayk directed this houseplant research, which was

conducted from 2019 to 2021, pre- and post-pandemic.

“One of the most important things we found is that consumers felt plants helped them throughout the pandemic to deal with stressful thoughts and feelings,” he shared. “This is where the pandemic changed everything.”

In the research, roughly 72% of plant buyers reported that houseplants make them feel happier, while 44% reported feeling great optimism about the future even though COVID-19 heavily affected their personal and professional lives.

“Houseplants make people feel good,” Hayk added. “This is good news for the industry.”

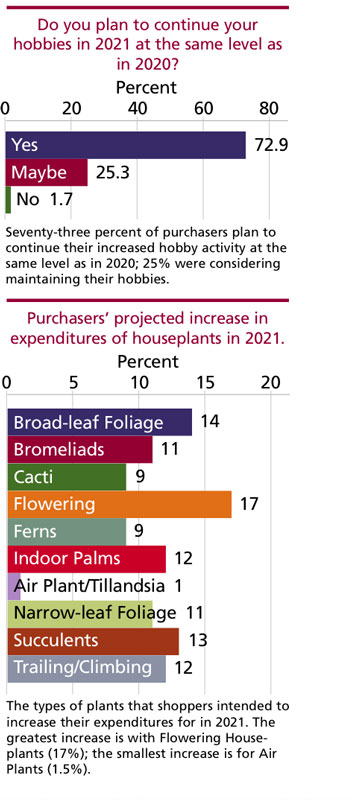

But would the pandemic-generated sales boost carry beyond lockdowns? In short, yes. The majority of plant purchasers (72.9%) declared their intentions to keep on pursuing this happiness-generating hobby of caring for houseplants in 2021. You probably only need to look to your own sales trends to know this statement is true, but empirical data really tells the tale. Personal consumption expenditure data from the Bureau of Economic Analysis for flowers, seeds and potted plants confirms this market growth, with each month of sales in 2021 surpassing 2020 on a year-over-year basis.

The last point about the houseplant market that’s worth taking to heart is that, “relatively speaking, the market side of change has been occurring at a greater pace than the production side,” Hayk said. That means the who, what and where of houseplant buying is surging forward, shaping the market. The houseplant study is packed with information that can inform the production process, plant inventory, packaging and marketing campaigns.

The last point about the houseplant market that’s worth taking to heart is that, “relatively speaking, the market side of change has been occurring at a greater pace than the production side,” Hayk said. That means the who, what and where of houseplant buying is surging forward, shaping the market. The houseplant study is packed with information that can inform the production process, plant inventory, packaging and marketing campaigns.

Who’s buying houseplants?

Millennials and Gen Z have typically been tagged as the exploding houseplant segment—that’s likely due to their rampant use of social media. Houseplant posts create a highly visible online presence that has likely helped build momentum in houseplant sales. But if you market solely to unmarried Millennials and Gen Z, you’re going to miss entire market segments.

“The study showed a shift increase across all categories of houseplant buyers,” Hayk said. “We cannot ignore other generations. There’s representation across the board in age, gender, household size and geographic location for those who purchase houseplants.”

He feels the study indicates that there’s a deepened houseplant appreciation among Baby Boomers and Genera-tion X consumers.

According to the study, regular houseplant purchasers tend to be small households with an average of two adults (tend to be married) and no teens or children. Purchasers typically have some college education and are usually more affluent than the average American household. The average age of houseplant buyers is 51.8, although younger consumers (Gen Z and Millennials) are strongly represented.

From 2019 to 2021, there was a shift in where plant purchasers lived, which again reflects the impact of the pandemic lockdowns. In 2019, buyers tended to be in rural or small-town settings, while in 2021 purchasers were more likely to be in metropolitan or suburban areas in the Southeast and Mid-Atlantic regions.

What consumers want

The study included 10 types of houseplants—broad-leaf foliage, bromeliads, cacti, flowering plants, ferns, indoor palms, air plants, narrow-leaf foliage, succulents and trailing/climbing plants. The top categories of houseplants people are buying? Flowering plants, broad-leaf foliage and succulents.

“Flowering houseplants are the most purchased plant category,” Hayk said. “The gravitation to color and flowering plants is actually a subconscious response that occurs as part of the visual sensory part of the brain.”

The greatest spending occurred for bromeliads and indoor palms, which typically carry a higher price tag.

Many consumers view their plants as “home décor that just happens to be a live product,” Hayk said. Most often, houseplants are destined for the living room or bedroom (70% of respondents), followed by the kitchen (47%).

The container a plant comes in also influences the purchase decision. The most important container attributes included style, smart watering feature, color and shape.

“Should you pay attention to pots? If 37% of customers think that attribute is important, that should be a signal for you in your product experience campaign,” he added. Container texture, material, sustainability and brand were relatively less important to consumers.

Where consumers buy houseplants

Home improvement stores and independent garden centers earned the top spots for where people buy houseplants, but there really wasn’t a large difference between any of the retail locations listed.

“Typically, the reason a home improvement store rates as the top outlet choice is because it’s strategically located near other shopping. It’s difficult to compete with location,” Hayk said.

Price also plays a role in purchase decisions. “Over and over in surveys people say that price is not important, that they’re looking for quality,” he added. “That’s true for plant enthusiasts, master gardeners and gardeners over 50 years old who are educated. But this isn’t a large segment of the entire market.

“So price is not the most important aspect in purchasing decisions, but it’s near the top priority. It’s subconscious—people always look at the ratio of what they’re getting for the price. They’re always comparing prices mentally.”

He suspects that the greatest influencers on buying locations would be, in order: quality, price and selection.

While some plant purchasers engage with e-commerce retailers, they express some caution with buying live plants online. The possibility of receiving plants damaged during shipping and being unable to see the product prior to purchase were two of the top hurdles to e-commerce outlets. But plant buyers did indicate that they planned to increase online purchasing by 53% into 2021.

Strategies to build houseplant sales

Whether you’re a grower or independent garden center owner, you can increase your profit from houseplant sales. The study reveals several opportunities for plugging into the green plant movement.

Promote positivity. Call it “houseplant happiness” or “feel-good greenery.” Focus your marketing messages to promote the fact that houseplants make people happy and help diffuse feelings of stress.

Cultivate buyers. Craft your marketing campaigns to attract first-time buyers, as well as repeat purchasers. Houseplants have gone beyond being a gift purchase to being standard home décor. Build sales by selling plant packages arranged by decorating purpose—plants for Zoom backdrops, good kitchen plants, work-from-home plants for desks, dramatic floor plants or air-purifying bedroom plants.

Improve service. Whether you’re trying to increase your customer base in general or simply for houseplant sales, Hayk stressed that “customer service is the key. Home improvement stores are the No. 1 outlet for plant sales, with independent garden centers at No. 2. Individual customer service is where garden centers can shine.”

Explore pricing options. “It’s quite possible that the industry is leaving money on the table,” Hayk said. “Most survey respondents indicated a general willingness to pay higher prices than industry firms have been charging at retail—sometimes substantially higher.”

He suggests using a dynamic pricing strategy that spans a range from an entry-level houseplant purchaser (lower price point) to what a repeat purchaser who’s looking for trendy plants would embrace (higher price point). You know your market, but don’t be afraid to experiment.

Cater to non-purchasers. The study revealed that some people who rarely buy plants aren’t permanent non-purchasers, but are open to purchasing in the future. This is a potential market share that you can cultivate by promoting the wellness and health benefits of plants because 80% to 89% of non-purchasers consider health, mental health and financial to be important. GT

Article footnote: The Consumer Houseplant Purchasing Report 2021 was conducted by the Floral Marketing Fund, an organization created in 2011 by the American Floral Endowment focusing on floral purchasing and consumer marketing studies. You can download the full report, and others, on the FMF website (floralmarketingfund.org).

Julie Martens Forney is a freelance writer with more than 25 years of experience writing about floriculture industry issues and gardening for consumers. To read her current bylines, check out SAF’s Floral Management, HGTV.com and DIYNetwork.com. Julie’s also an avid gardener, tending edibles and perennials in a wildlife-friendly garden that features year-round color.