7/1/2020

COVID Reflections

Jennifer Zurko

What do you think about the industry’s response to the pandemic? What did we do right? What did we do wrong? And how do we move forward?

Anna Ball

Ball Horticultural Company

West Chicago, Illinois

I was visiting a retail customer in late May (the place was packed and the parking lot full) and the owner said, “Isn’t it weird that it took a virus for the industry to figure out we are essential?”

I would say one of the main things we did well as an industry is convincing ourselves and others that we provide essential emotional nourishment to the world. We are a necessity! We are important! That’s something to be proud of. We provide a remedy for so many ailments—both physical and mental. I even read the other day about the new idea of doctors writing prescriptions for gardening, instead of drugs.

We did a lot of other things well. We got creative in marketing and selling; our industry and state associations stepped up big time; we got smarter about pricing at retail; we showed we have a big heart with thousands of donations to hospitals and nursing homes; and we band together to voice our concerns to our politicians.

What didn’t we do well? We panicked early on and lost some momentum as a result.

Seriously, can you think of a better place to be right now than in the horticulture industry? I cannot! Every magazine, newspaper or social media site you read is talking about gardening and the benefits. All that free advertising is filling up the parking lots of retailers. We are right in the sweet spot.

But the next year will be critical for our industry. We will either grab onto this moment and make it last … or not. The key is a combination of offering the right product at the right time—and education. All those new gardeners—or rather new plant consumers—need to be successful or they’ll be one-time purchasers. They don’t need to become gardeners, but at least they need to become successful decorators. This is a once-in-a-generation opportunity to make our new consumers successful so we can get on our way to growing our industry.

I was in another retail garden center that day and next to me shopping was a 60-something couple. She was holding a basket of trailing petunias and was asking her husband if they were “the geraniums.” I couldn’t hold back and said, “No, ma’am—those are petunias and they take full sun.” She looked at me quizzically. “Full sun?” No clue.

Then she pointed to the flats of impatiens that had just been rolled in on a rack and said, “Well, those are geraniums then, correct?” I wanted so much to go home with them and help them plant so they would have a chance of being successful! We’re still a totally confusing and overwhelming new hobby for first-timers. We need them and the millions of others like them who have “discovered” us this year to be successful.

If we’re going to do that, we cannot offer tomatoes in March in the north. We cannot offer pansies and potted tulips in early June. Consumers buying those products will fail and we could lose them forever. We need to offer the right product at the right time. And we have to breed and produce more products that are totally easy to grow in containers or in the ground. More bulletproof/container-ready/no-sweat/no-care/no-experience-necessary products like the indestructible Dragon Wing Begonias, “more than 100 blooms” Sunfinity Sunflowers, Relax It’s Rio Dipladenias, disease-resistant Beacon Impatiens, heat-happy SunPatiens, and easy-care Knock Out Roses.

And to keep those new consumers successful, we need to provide simple education and care instructions. Simple and accessible. All information online, as well as at point of sale.

We’ve learned so much during this crisis about how we view our own industry and also how others view it—whether they be consumers going through the crisis with us, or government officials who challenged our thinking and wanted to know why we considered ourselves essential. With all of these newly gained perspectives, let’s learn from it and not waste the education or the opportunity. Here’s our chance to convert a new crop of consumers and show them the joy of plants. Let’s not miss it.

Scott Valentine

Scott Valentine

Syngenta Flowers

Gilroy, California

To truly answer the heart of this question, we need to consider as an industry if we’re doing enough to have a strong and unified voice with the goal of promoting the health and wellbeing of our industry. In short, the collective “we” in our industry needs to do more; we need to unify our industry, to build our collective voice and to proactively advocate for our businesses.

First, what did we do right? Syngenta Flowers was one of the first breeding companies that announced our decision to cancel our live CAST event when the nation was first facing the pandemic of COVID-19. This difficult decision was made specifically for the safety and wellbeing of our people, their families and our customers when there was not a lot of information coming from within our industry peers. Looking back, this was clearly the right decision.

Next, AmericanHort supported the united decision to cancel Cultivate 2020 early, which allowed participating exhibitors to react, adjust their planning and more effectively manage costs. Likewise, I applaud the trade media, who’s been quick to respond to rapid industry changes with information and resources for growers and retailers whose businesses and livelihoods were, and continue to be, in peril.

However, what went wrong? Although our webCAST event was successful, the industry didn’t come together to make a unified, timely decision on cancelling CAST 2020, but rather each breeding company had to make an isolated decision, one at a time. One possible factor is that the breeders and participants aren’t able to agree on a new structure and timeframe of CAST, leading to an uncertainty and ambiguity about how CAST will be organized in the future.

Also challenging with COVID-19 was the patchwork status of horticulture as an essential service across the states. As shelter-in-place orders rolled out, our industry faced significant impacts. Some of these impacts were because horticulture wasn’t deemed an essential service in some locations. Granted, hindsight is 20/20, but this may serve as another indicator that we’re not working as a collective voice for the strength and wellbeing of our industry.

So how do we move forward as an industry?

First and foremost, we need to strengthen, empower and actively participate in our trade associations to promote the best interests of our industry, and that starts with all of us. As an industry, we need to advocate for horticulture to be included as part of the agriculture definition of Essential Critical Infrastructure, as well as increase the visibility of our industry with key government stakeholders.

In addition, through our organizations and associations, we can and should do more to promote flower and vegetable plants as part of a public relations campaign, increasing the awareness of the benefits of gardening to a generation that’s passionate, powerful and willing. With the increase in retail sales of plants observed this spring, we should seize this moment to be our own best advocates.

There are issues outside of COVID-19 that also require the leadership of a strong association to build a lasting and healthy industry. One such issue is agreeing on how to handle disease issues across all levels of the value chain. With the volume of plants sold every year in North America, facing disease issues is inevitable and we need to standardize disease response for when, and not if, they arise.

This is an industry of passionate, ingenious people that successfully grow, ship and sell billions of plants every year. We need to harness this energy to come together and proactively take action, making decisions that positively influence our future. Let’s use this time in history as a wakeup call to mobilize our efforts and come together to raise the industry bar.

How has the coronavirus affected us economically and how we can use the data moving forward? What can we expect next year? And how does The Great Recession of 2008 compare with what’s going on economically now?

Dr. Charlie Hall

Dr. Charlie Hall

Ag Economist and Ellison Chair in International Floriculture

Texas A&M University

As I write this essay, the U.S. is in the process of reopening from the Great Shutdown brought on by the COVID-19 pandemic, with many hopeful that better times are ahead as the economy wakes up from its forced slumber. Many businesses are resuming limited operations and recalling workers, and many consumers have ventured out for the first time in months and begun the process of rebuilding the economy one exchange at a time.

But they do so with greater attention to personal space, some wearing masks and gloves, and even subjecting themselves to thermal imaging, antigen testing and contact tracing. These and other measures that were taken to flatten the COVID-19 curve will likely have long-lasting effects on consumer interactions and purchasing behavior.

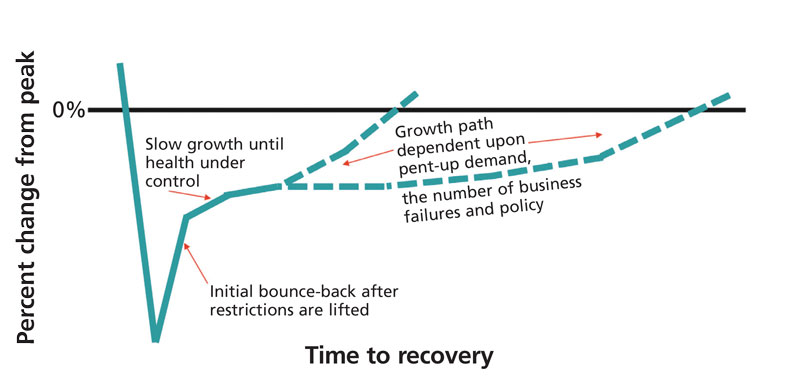

I’m afraid, however, that the economic recovery from this recession will likely be much slower than many want to believe. As more economic data became available throughout spring, I found myself changing my own projections about the “shape” of the recovery almost weekly. I no longer expect the recovery to resemble anything like a "V-shape" or a “U-shape,” nor do I expect it necessarily to be an “L-shaped” or “hockey stick” recovery like we saw after the Great Recession. Instead, it will likely be characterized by the initial sharp drop that we’ve already experienced, followed by a sharp bounce-back to a “higher-but-not-back-to-normal” level and a slightly upward-sloping recovery after that, with the steepness of that slope dependent on demand factors, supply-chain effects and policy influences.

Consensus expectations have now converged on the view that U.S. GDP will not exceed pre-COVID levels until sometime between 4Q 2021 to 2Q 2022. The nonpartisan Congressional Budget Office (CBO) recently released new analyses estimating that U.S. GDP would not recover to its prior peak until 3Q 2022. The CBO now expects the economy to contract at a 37.7% annual rate in 2Q 2020, then projected to rebound at a 21.5% annual rate in 3Q 2020, which would be the strongest quarter ever recorded. That pattern would fit my own projection stated above.

Consensus expectations have now converged on the view that U.S. GDP will not exceed pre-COVID levels until sometime between 4Q 2021 to 2Q 2022. The nonpartisan Congressional Budget Office (CBO) recently released new analyses estimating that U.S. GDP would not recover to its prior peak until 3Q 2022. The CBO now expects the economy to contract at a 37.7% annual rate in 2Q 2020, then projected to rebound at a 21.5% annual rate in 3Q 2020, which would be the strongest quarter ever recorded. That pattern would fit my own projection stated above.

There’s obviously a lot of uncertainty surrounding this forecast; the drop could be steeper or not as steep. The rebound could be faster or slower. GDP could be far below trend by late 2021 or it may be above trend. However, the general pattern (sharp decline, partial upswing, then gradual recovery) seems the most likely result, with the uncertainty revolving around the length of the gradual recovery stage.

Policymakers continue to discuss tools that can mitigate the economic headwinds from the current climate of higher savings rates and weaker business spending and, more importantly, stimulate long-term demand. Legislation passed thus far wasn't designed to spur increased economic output, but instead was designed as a short-term backstop to try and arrest the economy's freefall. Relief checks and short-term unemployment benefits aren't, by nature, expansionary.

COVID-19 not only exposed deficiencies in the U.S. economy, it demonstrated how susceptible business supply chains and healthcare are to a single point of failure. Just as the country’s reliance on foreign oil producers in the 1970s helped to spur the creation of domestic energy production, I would expect the issues associated with a “just-in-time” global supply chain to catalyze changes and spark significant domestic supply chain-related investment. The virus will also accelerate the adoption of B2B and B2C e-commerce technologies, remote working and strategic omnichannel relationships. I expect there to be continued shifts in how people consume, how they work, and notably, where they choose to live, thus bringing us to the subject of housing.

I expect the current undersupply of houses and the pent-up demand brought on by sheltering in place to converge and become an increasingly important economic force. At the same time, housing affordability is improving, mortgage rates are lower and other forms of debt service remain manageable by historical standards. But I’m keeping a watchful eye on housing prices, which are slowly creeping up on pre-Great Recession

levels.

But industries like housing can’t take off until the pandemic is fully contained and people become comfortable with this next “new normal.” The rebuilding cycle will be long, joblessness will remain elevated for several months and corporate debt burdens will limit financial flexibility for those firms that haven’t properly managed their working capital. Many companies will face inefficiencies as they shift supply chains, operate below full capacity and incur new healthcare-related costs. The strong companies are likely to get stronger, while headwinds will increase for

weaker ones.

In summary, economic data can be viewed in a variety of ways, but conclusions are obviously shaped by the perspective of the analyst. While I would be delighted to embrace truly more upbeat prognostications, I must remain as objective as I can in interpreting the data, which has been limited since this black swan event happened so quickly and it takes time for data to be evaluated accurately.

Benchmarking data from industry firms that I work with show that the effects of COVID-19 disruptions to date have been mixed and greatly dependent on the region of the country, the product mix being sold and the type of venue. Historically, the first stages of recessions have been kind to the lawn-and-garden industry due to consumers traveling less and curbing expenditures on durable goods (which has certainly been the case during COVID-19), prompting them to stay at home, and therefore, engage in more lawn-and-garden activity. It’s usually not until recovery begins and consumers start purchasing big-ticket items again that our industry feels recessionary pains.

I project this downturn will likely follow this historical pattern, so I suggest we enjoy the fruits of the current renewed interest in our industry brought on by the mandatory/volunteer “sheltering-in-place staycations” and prepare contingency plans according to the aforementioned shape of the economic recovery as it unfolds.

After the roller coaster of Spring 2020, how do you plan for next season and beyond?

Dave Dickman

Dave Dickman

Dickman Farms

Auburn, New York

We were incredibly lucky that, for us, the worst effects of the pandemic fell between peak young plant season and peak retail-ready season. A month or two either way would have been catastrophic. Further, we went from thinking we would have to hire a fleet of dump trucks on Week 12 to 100% sell-through on Week 22. Yes, that was a serious roller coaster ride.

How does one plan for next season and beyond is a fine question and requires consideration of several factors, ranging from projecting demand to reacting to a recurrence—possibly at a worse time of year.

We found our biggest pain point was labor. Early in the pandemic, we lost a portion of our seasonal workforce on whom we depend for production in April and shipping in May. This caused us to have to bypass planting a lot of product Week 17 through 21, resulting in a big gap of available product to sell mid-May into early June. That, of course, was compounded by high consumer demand in May. That said, our sales were up because we literally sold everything right back to the walls.

As far as projecting demand, we do think our industry gained new customers, re-engaged existing customers and their children, and that will give us a good bounce in demand next year and likely for some years to come. One thing we’ll be discussing in 2021 production planning meetings is what products we need to produce to keep these new customers engaged in horticulture. Then we’ll have to adjust how much of what we’ll grow. To a certain extent, that’s the easy part of the answer.

More importantly, we’re already engaged in discussions on how to mitigate the risk of a labor shortage should there be a recurrence. There’s no secret labor availability was difficult enough before COVID-19.

Our labor discussion has three main focuses: investment in more mechanical planting equipment, building more space to decrease manhours spent spacing product and adjusting crop templates to eliminate as much planting as possible during Weeks 19 to 22—peak retail-ready shipping weeks. This will require a deep dive into what we grow, how we plant it, how we maintain it and crop times.

We do have a mixed customer base of contract and speculative customers for retail-ready product, which did help get us through this tricky season. We’ve always thought the right mix of customers is prudent and having that flexibility helped move plants week-to-week through the pipeline this spring. In some cases, we’re considering an actual written contract, just so there’s a clear understanding of what happens if faced with similar circumstances in the future.

We’re optimistic about the future of our business and the horticulture industry in general. If the roller coaster of Spring 2020 has taught us one thing it’s the importance of the relationship of sell-through to profitability.

How do businesses in our industry remain “essential”? And how can associations like AmericanHort ensure that issues like labor and stimulus aid stay top of mind for our policymakers?

Craig Regelbrugge

Craig Regelbrugge

VP of Government Relations & Research

AmericanHort

Saturday, March 14, 2020

Dear Diary: I’m just back home from a series of plant health regulatory and research meetings out West. Felt a bit like running the gauntlet! COVID-19 seems firmly established here in the U.S. My team in D.C. has asked me to self-isolate after being on the road. A national emergency has been declared; states and localities are beginning to issue stay-at-home orders and decide which businesses are essential and which are not. They’re mostly looking to the federal guidance from Homeland Security. The good news is, our growers are generally recognized as Agriculture, so they and the workers are seen as “essential.” But the guidance isn’t so clear for garden retail and landscape workers. It’s going to be a heavy lift to keep the horticulture industry’s supply chain functioning. I think we’ll be better off in those places where the industry has invested in key political and policymaker relationships, and more challenged elsewhere.

Wednesday, March 25, 2020

Wow, crazy busy days for our AmericanHort advocacy team. On Monday, Charlie Hall and I did a “state of the industry” webinar. Just about 1,000 attendees! While so much is uncertain about what the weeks ahead will bring, many commented to us about how valuable the information we shared and how comforting to gather as an industry community. Today, we held a webinar with our partners CJ Lake and K•Coe Isom, unpacking the paid leave and tax provisions of Families First bill. Again, almost 1,000 participants!

AmericanHort launched our “coronavirus resource center.” Meanwhile, we’re fighting like crazy to keep the industry market chain intact. Spring is well underway in the warmer parts of the country and some market channels like supermarkets cancelled plant orders as they triaged their stores for the pandemic. In some places, independent garden centers are being forced to close or curtail operations. We’re in full battle mode over what constitutes “essential.” We’re collaborating with colleagues like Danny Summers to develop the “case statement” for why garden retail should be considered essential. And we’re supporting our state partners in trouble spots like Michigan and Pennsylvania.

Friday, April 3, 2020

Wrapping another long, but productive, week. The new Paycheck Protection Program went live; fortunately, those who tuned into our PPP webinars were well-prepared to apply and many are. We’ll continue the webinars as new guidance and potential Congressional tweaks are forthcoming. We also sent a letter to Agriculture Secretary Sonny Perdue outlining how COVID-19 has impacted our industry and urging inclusion in the Ag relief that Congress just passed as part of the CARES Act. On a good news note, the federal “essential worker” guidance was tweaked and now explicitly includes “landscapers.”

Friday, April 17, 2020

Whew, another tough couple of weeks! But we’re making progress. Last Friday, we sent another letter to Agriculture Secretary Perdue, urging inclusion of nursery and floriculture growers in agricultural relief. One hundred five national and state nursery, landscape and farm-lending organizations and farm bureaus joined on—a strong showing! And just today, the federal “essential workforce” guidance was tweaked again to include “workers supporting the growth and distribution of plants and associated products for home gardens.” A helpful tweak where we’re still battling retail garden closures.

Saturday, June 6, 2020

Well, May has come and gone. Thankfully, in most of the country, we’ve seen markets reopen, and strong demand for plants and supplies. In the face of the pandemic restrictions, it seems lots of folks staying mostly at home have reconnected with plants and landscapes. True, unemployment numbers are scary, but hopefully only temporarily. Meanwhile, lots of people are choosing to spend money in our industry. A great thing!

Since the start of the pandemic, health and safety of our employees and customers have been “priority 1.” Most have taken things seriously and our organization has provided a valuable forum for sharing ideas and “best practices.”

There’s concern about the future, of course. How will commercial and residential new construction fare? How quickly will folks get back to work? Will the connections we’ve forged and renewed with consumers persist?

There’s still work to do on the recognition of our industry as essential to human health and well-being, but we’re stronger now than before and have learned some valuable lessons. USDA relief for growers with major COVID-19-related losses is still under consideration … though we’re generally not food, as an industry, we’re responsible for over 2.3 million jobs! And right now, it’s all about jobs.

I’m pretty proud of how we were able to rise to many of the challenges brought by COVID-19. It’s been gratifying how many have said recently, “The value of our associations was on display more than ever during this time of crisis.” Beyond the pandemic, we continue to move forward on key research, plant health and transportation initiatives. Labor continues to be a major challenge. Even though the House passed a solid reform bill last December, given our political polarization and widespread hostility within the Administration, we’ll likely play more defense than offense over the next six months. But in all this work, remember: relationships still matter. Persistence and working together will remain essential to success.

How has COVID-19 impacted the horticulture industry in the European Union and how do we move forward as the virus continues to be a part of our everyday lives?

Matthias Redlefsen

Matthias Redlefsen

Ernst Benary Samenzucht GmbH

Hann. Münden, Germany

If we look at the effects of the Corona Crisis on horticulture in Europe, we have to differentiate between the immediate, the mid-term and the long-term effects.

Immediate effects— It depends on the country

Besides all the very legitimate health and social concerns, the general settings for our industry this spring could not have been better: weeks of perfect sun all over Europe, people staying at home with an unexpected amount of time and summer vacation away from home very likely to be cancelled. In other words: Consumer demand was perfect!

However, the extent to which stores and growers could benefit from these conditions completely depended on whether or not consumers were able to buy plants. That very much depended on the government response to the coronavirus situation in each of the European nations. Countries where a complete lockdown was in place and where horticulture was not considered “essential,” sales were stalled to a full stop. For horticulture in Italy, Spain, Belgium and England, this has had dramatic consequences—not just economically, but also psychologically: perfect demand and growers had to dump their products!

In European countries where the personal restrictions were less tight and where horticulture was considered “essential,” sales—after a shock of two to three weeks in March—were superb. This is the case for The Netherlands, Germany, Austria and Switzerland.

The mid-term effects— An unhealthy consolidation

In countries with a full lockdown, the Corona Crisis will act like a strong catalyst to the general industry consolidation. This consolidation trend is not new and normally follows a healthy pattern of some growers and retailers stepping out of business (often due to family succession), while others take over and build more critical mass. However, due to the Corona events, this process may fall out of balance for the next 12 to 24 months. The risk is that, in some countries, too many growers took too strong of a hit and too many of them will not find a fair buyer for their operation and will slide into bankruptcy.

To which extent this trend will come true very much depends on the government’s attitude towards horticulture and their willingness to financially support the horticultural industry. My guess is that this will be tricky, since the affected countries were already those nations that did not declare horticulture “essential” during the acute time of the crisis. So why should they now?

The long-term effects— A gardening renaissance

While the short- and medium-term impact very much depends on the country the grower lives and operates in, the long-term impacts on our industry will be more or less the same for all over Europe. And they are good news!

No matter who you talk to these days, everyone agrees that this crisis is the starting point for a gardening renaissance. This spring, gardens were rediscovered. New, young consumers have had their first experience with the beauty of our products and many of them will stick to it. This trend is fueled by today’s general concerns and the subsequent cocooning effects: The more uncertainty people feel in the “outside world,” the more security and well-being they want in their “inside world.”

Two further trends will affect this growing consumption in Europe: First of all, online purchasing will become a serious sales channel. The new, younger consumers are used to buying everything online, plants included. And more, they expect it. But now more traditional consumers have had their first experience with online plant purchasing options. They are discovering that ordering online can not only work, but it’s a huge convenience!

My take is that this channel will now gain critical mass and will start to develop the disruptive energy like it has in many other industries before us. But unlike those other industries, where the majority tried to fight online trends until they couldn’t stop it any longer, we should embrace it and be an active player in it.

Last, but not least, the Corona Crisis has brought to the forefront the very personal risks for everyone involved in a global supply chain. This new awareness combined with an exceptionally strong environmental awareness in Europe will put a big question mark on global supply chains. Why does a pot need to come all the way from Asia? Why does a cutting need to come all the way from Africa? Consumers will not only request much more transparency on the supply chain, they will prefer anything that is local and ask for a good justification for anything that is not.

Bottom line: While the Corona Crisis presents some serious challenges for horticulture in Europe, especially in the countries with a full lockdown this spring, the long-term perspectives are good for most. And they can be even greater for those of us who embrace the chances within it.

What role should our industry associations play during this pandemic crisis? How are you supporting your members?

Ken Fisher

Ken Fisher

President & CEO

AmericanHort

Fortunately, it’s infrequent that we’re faced with a crisis requiring “battlefield” tactics to manage through uncertainty and potential chaos. The recent external events have considerably impacted personal and professional lives. At AmericanHort, we’ve been able to leverage our association capabilities, in which we’ve invested over the past three years, for the benefit of our members and our industry.

Intel—Amid the initial chaos of “essential and non-essential” business designation and state-by-state regulations, our daily intel became a critical component to keeping our supply chains open, markets fluid, and discovering best practices to ensure the health and safety of employees and customers. AmericanHort is on the frontlines identifying, collecting and assessing the supply chain intelligence coming from across the country.

Communication—It’s difficult to make good business decisions in times of uncertainty or without good knowledge in a rapidly changing business environment. AmericanHort has leveraged our communication capabilities to provide daily, updated information to our members and the industry. We quickly established a Coronavirus Resource Center website with all incoming information, analysis and recommendations. We’ve offered technical webinars with our labor, legal, advocacy and financial partners. And we’ve provided “steady counsel” in a time of chaos with Craig Regelbrugge and Dr. Charlie Hall giving their insights on the industry, advocacy and economic climate of the day. (See their essays on pages 40 and 37.)

Our goal has been to: “tell as many people as much as we can as soon as we can.” We’ve also kept up a steady cadence of educational programming, including webinars on communicating during a crisis, helping garden retailers pivot to non-contact sales, understanding the Ralstonia issues, and will offer over 50 online educational sessions during Cultivate’20 Virtual in July. We’re using our considerable resources in print, digital, webinars, social media and conference calls to keep our industry informed.

Collaboration—A strength of AmericanHort is the broad reach and coalitions we have with our members and the industry. As a partner with Nursery and Landscape Association Executives, we have resources on the ground in nearly every state to provide intel, communication and influence at the local level. We team with industry leaders like Danny Summers’ Garden Center Group and Dr. Charlie Hall’s EAGL group on real-time status of garden centers and growers across the country.

On advocacy and industry issues, we align with other association executives like Andrew Bray and his colleagues at National Association of Landscape Professionals. And we’re fortunate to have strong collaboration with the labor/legal team at CJ Lake and the finance/tax/accounting team at K•Coe Isom, whose expertise has proven invaluable to help navigate the details of government labor regulations and stimulus packages. Our members provide valuable counsel through our Community Connector Groups and HR Peer Sharing groups, among others.

Influence—The AmericanHort advocacy team has the relationships and experience necessary to protect and serve our industry. In the last 60 days, we’ve organized 105 industry associations/coalition partners to sign on to our messaging to Secretary of Agriculture Sonny Perdue to ensure equitable treatment for our industry in the stimulus packages. We mobilized 23 Senators and 123 Members of Congress for a similar AmericanHort-initiated letter to President Trump and Vice President Pence. We teamed with California Farm Bureau Federation to discuss with the USDA Agricultural Marketing Services Administrator the case for payments to our industry. We’ve been in communication with governors to make the case for “essential” treatment of our industry. And we recently pulled together board members, association leaders and our chief economist to discuss with USDA leaders how they can best provide financial support to our industry.

Leadership—AmericanHort is positioned to be a trusted industry leader in both good times and bad. I ask our team every day to work diligently to build that position—one that’s earned over time. AmericanHort is the industry’s steady voice in a storm, providing confidence and experience to our members so they can manage their businesses knowing we’re working on their behalf. Your membership in AmericanHort allows us to continue these investments in industry assets that we can leverage to protect and grow our industry.

Kate Penn

Kate Penn

Executive VP & CEO

The Society of American Florists

It’s in the worst of times when associations are asked to do what they do best: help support their members and their industry. When I reflect on the work our industry’s associations have done over the last three months, one word that comes to mind it is connection. We connect our industry with legislators and government officials (and vice versa); we connect our members with each other to share best practices and learn new ways of buying, selling, operating; we connect our industry with curated content and expertise. And while we all do this kind of work year-round, this posed an existential threat the likes of which none of us had ever experienced, so we had to re-write the script as we went along.

For SAF’s part, we learned early on that our industry needed help navigating the state and local orders. The orders defining essential businesses were confusing and changing daily. We saw a lot of businesses defaulting to a closed position, when in fact many states or municipalities allowed e-commerce and touch-free deliveries to continue. While we don’t usually pay attention to local regulations—we focus on the federal level—we quickly rewrote the script and mobilized to create a state resources page within the COVID resources on SAFnow.org so floral business owners could make an informed decision about whether or not to stay open. We also made a case to every state governor to allow floral businesses to do e-commerce and touch-free deliveries, considering their ability to operate within CDC guidelines and also the important role flowers and plants play in creating happiness and connections.

Along with the prospect of closing their businesses, there were all kinds of operational decisions business owners had to make regarding staffing, safety protocols, sourcing product and so much more. To address this, we produced webinars on the fly to provide insight into these issues—two to three a week through March, April and early May, led in most cases by floral industry peers. Here again, we re-wrote the script and opened these webinars though Mother’s Day up to the entire industry, SAF members and non-members alike at no charge. We knew that the more floral businesses we could help get to the other side of this crisis intact, the better it would be for the entire industry.

All along we’ve also wanted to help the industry remind consumers about the power of flowers as a way to connect, so we created a whole series of social media tools and banner graphics reinforcing this through the spring months and Mother’s Day. We also played our usual role as the go-to outlet for the media in the weeks leading up to Mother’s Day—this year, reinforcing how flowers and plants are a safe and perfect gift to give during the pandemic was a key message.

Since Mother’s Day, we’ve re-tooled our content and education efforts to focus on helping businesses re-open safely, drive local sales and reimagine what their business looks like in this “new normal.”

The only script that involved no kind of re-writing was the one for our advocacy efforts—our seasoned advocacy team lobbied for the CARES act so our industry’s small businesses could have access to forgivable loans. At the same time, we were working to ensure that floriculture growers could apply for the USDA Coronavirus Food Assistance Program—this would be a first, as the USDA has never provided direct aid to floriculture on a national basis. Once again, this is where connections proved vital—we coordinated a floral industry coalition with other industry organizations, including the Association of Specialty Cut Flower Growers, California Cut Flower Commission, CalFlowers, Certified American Grown, and the Produce Marketing Association to make the case that domestic floriculture needs to be supported to overcome this existential threat. We successfully secured the aid in late April and have since been working with the above organizations, as well as AmericanHort, to ensure the formula the USDA uses to calculate aid payments for the floriculture industry will reflect the harm our industry has experienced.

Moving forward, we know that there will be a new normal—for consumer behavior, supply chain logistics, workplace operations and so much more. To that end, we’re embracing our role as a thought leader by developing a series of virtual events we’ll be rolling out this summer, designed to inform, inspire and, of course, connect the industry in some really thoughtful and provocative dialogue. We want to help our industry explore what this new normal looks like and how progressive, growth-minded floral business owners can leverage it. We’re excited about the connections yet to come.

Ben Bolusky

Ben Bolusky

CEO

The Florida Nursery, Growers & Landscape Association

Normal. Such a quaint word now.

It’s how we used to describe the comforts of our routine, everyday lives before the coronavirus’ sudden onset turned our worlds upside-down and our lives inside-out.

Pandemic or not, FNGLA’s primary role is to promote and protect the interests of Florida’s nursery and landscape businesses. In so doing, FNGLA keeps its pulse on rapidly evolving policy decisions in our state capital and the nation so our members don’t have to do so on their own.

Essential. With the coronavirus breaking, FNGLA pressed state and local government leaders to explicitly acknowledge (or provide “sufficient bandwidth”) the essential business services of Florida’s $25.4 billion nursery and landscape industry. Successfully enabling much of our industry to avoid shutdown, these welcome pronouncements allowed FNGLA members to make their own business decisions whether or not to remain open.

Eligible. As Congress was stitching together its massive stimulus bill, there was word of a new small business loan program for all industries. However, FNGLA knew several Small Business Administration programs historically exclude agriculture since USDA ran parallel programs. So FNGLA jumped into the fray with Florida’s congressional delegation to guarantee small businesses in all industries—including agriculture—would indeed be eligible for what became known as the Paycheck Protection Program.

When USDA unveiled the direct support payments under the Coronavirus Food Assistance Program, passed hurriedly by Congress, nursery crops were not among the list of eligible commodities. FNGLA and AmericanHort have led the national push to help USDA understand how it needs to add nursery/floriculture crops so our growers can be eligible to apply for this direct pandemic assistance.

Extend. As others throughout our nation, FNGLA members were already juggling far too much as Spring approached. Seemingly overnight, our members were forced to grapple with wholly unfamiliar coronavirus protocols. They had no choice if they wanted to keep their businesses running, employees safe and families healthy. This massive daily cascade of information was, in a word, overwhelming.

To help our members cut through these wild gyrations, FNGLA issued special alerts and devoted our weekly e-newsletter to extend succinct information. FNGLA cut through the reams of info, distilling and tailoring it specifically for our members. In turn, they were able to share it directly with their accountants, HR managers and financial lenders. By interpreting and extending this avalanche of information for our members, they didn’t have to do so and could continue to focus on their businesses. FNGLA consolidated the most critical info into a Coronavirus Resource Center—a special, one-stop-shop on FNGLA’s website (fngla.org/advocacy/resources-coronavirus).

Earn. Industry associations should assess how best to earn their members’ trust. Industry associations must be dependable and resourceful pillars on which their members instinctively know they can lean during any crisis. By earning and safeguarding such reputations, industry associations can sharpen and maintain their everyday relevance to their members.

Encouraging. We now find ourselves at an uncertain and awkward juncture. It’s tough to know what to do. No one really knows how to shape or decipher what our “new normal” will be. Our industry associations, too, are wrestling over how best to serve our members in this unexpected world. Yet, we’re certainly learning a new role: cheerleaders to encourage our members.

Advocate remedies. Communicate facts. Offer guidance. Deliver encouragement. By embracing these roles every day, and during moments of crisis, our industry associations can indeed stand tall in the eyes and hearts of our members, pandemic or not. GT