7/30/2014

State of the Industry: It’s All About Supply & Demand

Nicole Wisniewski

It’s been a long, slow journey, but the housing and commercial construction markets are definitely continuing on their path toward recovery. Six years after the crash, this is good news for landscape and nursery businesses that rely on residential and commercial sales and starts to feed their business pipelines.

But there are some challenges impacting landscapes and nurseries this year, placing a few unexpected bumps and detours on that road toward revival. The big one: As interest in landscape projects—and the resulting business—picks up, nurseries are having a hard time supplying the plant material needed to meet the demand and those who have the goods are raising their prices. Along with this comes the continued challenge of finding employees to do this additional work.

So, while landscape professionals aren’t complaining about the demand, they know fulfilling client needs may mean better planning, pricing, staffing and customer communication.

A rocky start, but then the season took off

In many areas of the country, it was a long, cold winter and sluggish spring for landscape and nursery professionals early this year. And if one region wasn’t experiencing a seemingly endless winter, another region had the opposite problem: record drought.

Not that this limited interest in landscaping. If anything, in many regions people were even more eager to get started and think spring. Some nurseries delayed their opening days, but once the season kicked off and people came out of their winter hibernation, demand came with it en force.

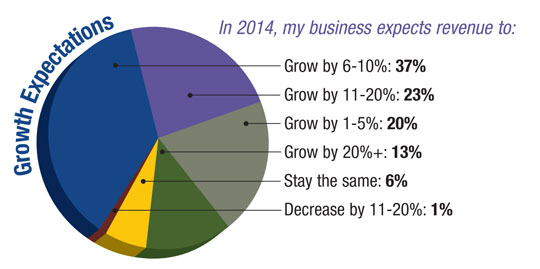

According to HindSite Software’s Green Industry Benchmark Report, 93% of green industry professionals expect to grow revenue in 2014, up from 75% last year.

The 2014 Residential Design & Renovation Outlook that surveys building, remodeling and design professionals from Houzz coincides with this research—90% of the experts surveyed expect revenue growth in 2014. And a full 80% of landscape architects answering the American Society of Landscape Architects’ 2014 Business Quarterly survey reported stable to significantly higher inquiries for work the first quarter of this year.

A majority of U.S. homeowners (53%) even report they’re ready to remodel in the next one to two years to boost the value of their homes, per the Houzz survey. While bathroom and kitchen remodels or additions topped the list of planned projects, patio and landscape additions and renovations ranked No. 4 with 17% of respondents indicating this. Deck or porch additions/alterations came in at

No. 6 at 14%.

While the housing market is recovering, homebuilding is still at only half its normal level, according to the National Association of Home Builders. Last spring, there was a definite pickup in home prices and construction, but then mortgage rates went up and credit became tighter, so that momentum came to a halt. NAHB currently reports that homebuilder confidence is at its lowest level in a year, but they’re optimistic sales will pick up over the next six months.

Demand is high, but supply is low

Commercial customers are pursuing projects at a good pace this year for Chicago’s Sebert Landscaping, according to General Manager Steve Pearce. But during the recession, demand for plant material shrunk as a result of halted housing development and sales.

“Plants were dumped for low prices in the effort to move material,” explains Julie Joyce with Barn Nursery & Landscape Center in Cary, Illinois. “While some nurseries closed down, the ones that survived the recession were unable to plant large amounts of new plant material.”

Steve notices this most with trees today. It takes a 1-in. diameter tree approximately three to four years to grow into a 2.5-in. tree, depending on the variety, Julie explains. “Three to five years later, we are seeing the effects of this minimized planting schedule,” she says.

“The tree market is changing fast,” agrees Timothee Sallin, president of Cherry Lake Tree Farm, Groveland, Florida. “Availability of core items is becoming a major concern as we are beginning to see shortages in 2-, 3- and 4-in. material.”

As a result, prices are going up. During the recession, Steve says he could get some materials for $75 that are at least $225 today. Materials that would normally sell for $350 to $500 can’t be purchased for less than $600 today, he points out. “Nursery materials are already short, so with more demand from more contractors continuing over the next few years, it will be interesting to see what happens, especially with trees,” he says.

Julie concurs. “What remains available for sale is being sold for premium prices,” she shared on the company’s blog. “Even on spring reorders, we are seeing price increases of 30% to 50%.”

“The shift in the market has been dramatic,” Timothee says. “Items that were oversupplied and deeply discounted less than one year ago are now very scarce and selling at high premiums. This has many scrambling to adjust, causing serious disruptions to both buyers and sellers. Growers, landscape contractors and distributors find themselves having to raise prices while fulfilling existing contracts and managing inventory availability.”

Make 2014 a banner year

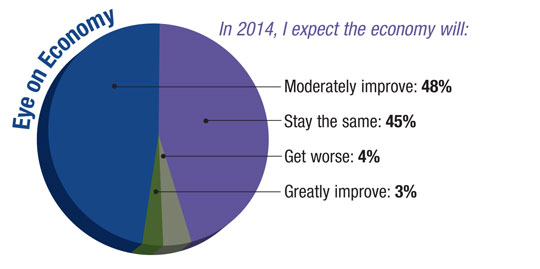

While green industry professionals remain cautious about the economy overall, they’re encouraged by consumer confidence, which seems to be stabilizing, but continues to ebb and flow because of prolonged unemployment. Approximately 74% of U.S. homeowners say the housing market in their area has improved in the past year, according to Houzz research. This sentiment is highest among homeowners in the West (85%) and the South (73%). Homeowners in the Midwest (71%) and Northeast (66%) are more temperate on the recovery. Of course, homeowners who report an improved housing market are more likely to be planning a remodel (42%), the research shows.

A recent analysis by Builder magazine concurs with these figures, showing demand for housing is especially high in areas with thriving economies and employment growth, such as the San Francisco Bay Area, Austin, San Antonio, South Florida, Houston and Las Vegas.

Although tempered by the economic recession and subsequent decline in consumer spending, residential housing and construction activity, the U.S. landscape services market is still expected to recover poise and reach $80.06 billion by 2015, according to Global Industry Analysts’ report on the landscape services market.

Because consumer confidence and housing are still shaky, it’s no surprise green industry businesses feel the economy is still the single biggest external threat to their businesses, though it’s become less of a threat than last year (only 33% this year versus 46% last year, per the HindSite research). And as a result of increased operating costs, nearly 70% of respondents to that same study say they plan to increase their prices this year.

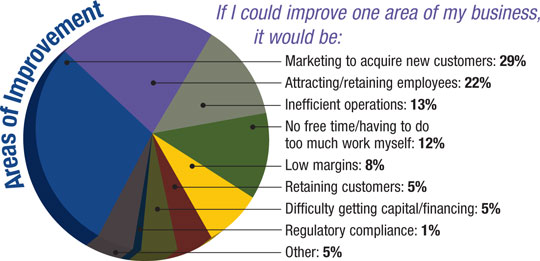

Marketing continues to be the biggest area in need of improvement for green industry businesses with 29% saying they have a challenging time marketing their companies, followed by attracting and retaining employees (22%) and making operations more efficient (13%), according to the HindSite survey.

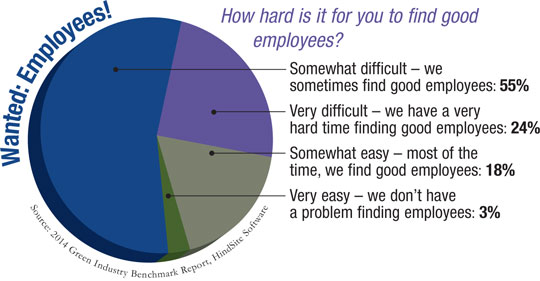

More opportunity for revenue is also creating more demand for workers. Nearly 75% of green industry business owners answering the HindSite survey say they plan to grow their staffs in 2014—nearly 25% more than 2013. But 79% say finding good employees is somewhat or very difficult.

HighGrove Partners’ Gib Durden says filling green industry jobs remains a challenge, particularly as work from the company’s commercial clients increases and horticulture schools continue to report declining enrollment. “We have to keep promoting our industry as an attractive one for careers and growth,” says Gib, who’s the vice president of business development for the Austell, Georgia-based company.

Concerning the plant shortage, Timothee says green industry professionals should expect a five-year cycle of shortages. “The long production time for producing trees means that very little can be done in the short term to increase availability,” he says. “Our expectation is that prices will continue to rise and will likely exceed the peak levels reached in 2007.”

Both Cherry Lake Tree Farm and Barn Nursery have taken a proactive approach to addressing the plant shortage situation, which is what industry experts recommend. Julie lists fighting for the best quality plant material at the best price, offering great alternatives for popular plants that are sold out, planning with clients ahead to ensure best selection and encouraging customers to order what they need now so they have it as some of their top ways for meeting client needs.

When it comes to business planning for the remainder of the year and into 2015, Charlie Hall, a professor in the department of horticultural sciences at Texas A&M University and Ellison Chair in International Floriculture, recommends landscape nursery retailers focus on a superior understanding of the consumer (purchasing behaviors, preferences, etc.) and a need to turn this business intelligence and data into actionable insight. “We don’t have to convince people to garden and landscape,” he says. “We have to convince them that we’re relevant. People will buy what they want.”

GT