6/27/2013

Cost Accounting: Enterprise Modeling

Bill Swanekamp

You may be weary of hearing about cost accounting, so rest assured that this is the last of five articles on Cost Accounting for the greenhouse industry. But, by design, this is the most exciting aspect of this laborious task. We’ve reached the reward for our labors. This is where we put all the components of Space Utilization, Seasonality and Shrinkage to work.

What is Enterprise Modeling? It’s the process whereby we determine the profitability of each crop that we produce. Why is it important to do this? With the tight margins that affect our industry, it’s important to determine which crops are most profitable and which are least, and then, for example, we can decide to grow more of the profitable crops and less of the marginal ones. It’ll also guide us in deciding whether or not we need to raise our prices or possibly even lower them. In addition, we can formulate a strategy for pricing an entire group of crops, such as plugs or rooted cuttings. For example, if we’re in the plug business, we could make the decision that we want to have a profit of $5.00 per plug tray after all costs. Since the cost of seed varies greatly from $.001 per seed to 25 cents per seed and the length of time in the greenhouse can vary from three weeks to 14 weeks, there’s a huge difference in the cost to produce each crop. This means we need to adjust our pricing to satisfy these various situations. Enterprise Modeling allows us to do this. Below is an example of how to do a crop-specific model and its value as a tool is easy to see.

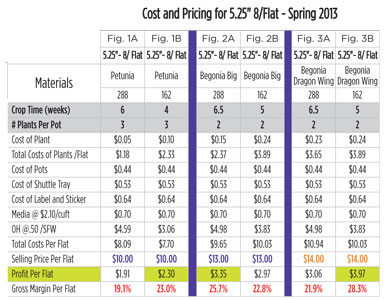

This table allows you to examine three different flower varieties grown in 5.25-in. pots—8 per flat for spring production. Figures 1A and 1B show the comparison between starting a petunia variety from a 288-plug versus a 162. In this case, the profit margin is greater when the petunia is started from a 162-plug. Why is this? Even though the cost of the 288-plug is half of the 162—since the crop time increases from four to six weeks when the 288-plugs are used instead of 162-plugs—the savings is in the reduction of time the finished flat is in the greenhouse. This highlights how expensive greenhouse space really is, and when more of the growing time should be spent in the close quarters of a plug tray rather than in the final pot size, the overall production costs are reduced and a higher profit margin is realized.

In Figures 2A and 2B, the savings found in the previous example aren’t realized because the amount of time to finish the Big Begonia from a 288 versus a 162 is not as great. Using a 162 Big Begonia only cuts 1.5 weeks off the finishing time. So, in this example, it makes more sense to use a 288-plug rather than the 162.

Finally in Figures 3A and 3B, the profit on a Dragon Wing Begonia is much higher if a 162-plug is used rather than a 288. The savings in this case are in the cost of the individual plug. Dragon Wing seed is very expensive and, because germination losses are higher in the 288-tray, the cost between the two starter plants is minimal.

The point is that by doing this kind of cost accounting you can clearly see how varying the size of the starter plant and its subsequent effect on the number of weeks that the finished tray is in the greenhouse has a dramatic effect on overall costs and profitability.

Using this type of modeling will allow you to make better decisions as to what size starter plants to use and their contribution to your bottom line. In the end, you should realize higher profits when using all the various aspects of cost accounting, such as Space Utilization, Seasonality and Shrinkage and then making valid comparisons with Enterprise Models.

GT

Bill Swanekamp is president of Kube-Pak Corp., Allentown, New Jersey.