10/26/2012

Cost Accounting: Seasonality

Bill Swanekamp

The two previous articles about cost accounting dealt with space utilization and how to allocate overhead to hanging baskets. This article will deal with the second of the 3S—seasonality. We’ll cover shrinkage in the next article.

Seasonality is the most difficult of the three concepts to understand because it cannot be defined by a simple formula or equation. The basic premise behind seasonality is that most greenhouse businesses don’t generate their revenue equally throughout the year. In fact, the majority of greenhouses generate the lion’s share of their gross sales during the winter/spring season. This, of course, is in contrast to the summer/fall season, which realizes little sales during the summer months, and then sees an uptick during September and December when we grow hardy mums, poinsettias and pansies. Even with this uptick, the total volume of summer/fall sales falls far short of the winter/spring period. As we all know, there is little to no profit in growing these fall crops.

Additionally, a great number of greenhouses spend the summer/fall season doing repairs and maintenance to their facilities. And if new construction is going to be done, it’s usually planned for this same period. In most cases, the need for additional greenhouse space is not based on the summer/fall demand, but the winter/spring rush. For most of us, we look to turn product through the greenhouse in the winter/spring as quickly as possible because we all know that we only make money on the crops grown in that period. Also, look at the total number of employees you have during the winter/spring season versus the summer/fall. In our case, we employ less than half the number of employees in the summer/fall compared to the winter/spring season.

What does all of this mean? It means that if we equally allocate our overhead on an annual basis to growing crops, then we’re allocating the same dollar amount per week per square foot, regardless of whether it was grown in the winter/spring or summer/fall. For example, let’s say your overhead per square foot week is 20 cents, then you would use this same number for SFW regardless of the season. Now we already know that our overhead costs aren’t generated equally over the year. As we add more employees during the winter/spring period, use more fuel and electricity and chemicals for PGRs and fungicide applications, then costs that make up overhead are truly accrued during our peak production and selling period. This means we need to allocate our overhead to the season that generates the greatest costs.

The que

stion is: How do we do this? One simple way to do it is to allocate your overhead costs based on gross sales per period. If we divide the year into two periods, January to May and June to December, then we can capture the corresponding costs of overhead and sales during the same period. The first step of the process is to add up gross sales for the January to May period and divide this by the annual gross sales. You’ll come up with a percentage. In our case, this number is around 76%. This means that summer/fall gross sales are around 24% of gross annual sales. (Table 1 illustrates this.)

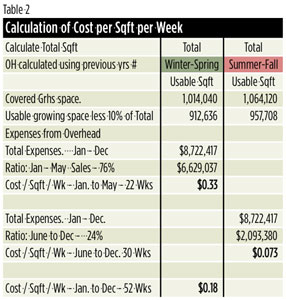

Table 2 illustrates how to use this information. We first need to know the amount of covered greenhouse space we have and deduct 10% of this for unusable space, such as aisles. This gives a total square feet of usable space of 912,636 for the winter/spring season. Next, we need to know what our total overhead expenses are for the entire year. In this case, it’s $8,722,417. We then multiply this by 76% and come up with $6,629,037. Next, this number is divided by 22, which is the number of weeks from January to May. The result is 33 cents per square foot per week of overhead. This is in contrast to the 18 cents annual cost per square foot that’s shown in the bottom of the column. The point of this illustration is to demonstrate that the amount of overhead we should allocate per square foot is much different between the winter/spring season and the summer/fall season. By using these numbers, 33 cents for the winter/spring and 0.073 cents for the summer/fall, we’re more accurately allocating our overhead to the season in which the expense occurs.

Once you think about these numbers, you’ll realize that compared to the old method of applying just one overhead cost equally throughout the year, your overhead costs for the winter/spring period are much higher than you may have thought and your profit lower. By the same token, your overhead costs for the summer/fall period are much less than expected and crops that have had low profit margins might really add a little to your bottom line.

GT

Bill Swanekamp is president of Kube-Pak Corp., Allentown, New Jersey.