1/1/2024

Exploring New Market Channels

Xuan Wei, Hayk Khachatryan, Charlie Hall, Marco Palma & Ariana Torres

The green industry is a vibrant segment of U.S. agriculture, with significant economic contributions of $17 billion at the farm gate and $348 billion in total output, while supporting over 2.3 million jobs. With an array of different stakeholders, including growers, retailers, breeders, suppliers, landscape designers and installers, the industry has many small and family-owned businesses, and some are into their third or even fifth generation of family ownership.

Despite its considerable size and impact on the economy, the green industry faces the critical challenge of slowed growth and heightened competition as it confronts a matured market stage. In the battle to maintain or gain market share, understanding market access and distribution channel selection as part of a broader competitive strategy is more vital than ever. The comprehensive analysis by Wei et al. (2023) dives into the National Green Industry Survey data from 2004 to 2019 to shed light on the strategic decisions of firms in market participation and market channel diversification.

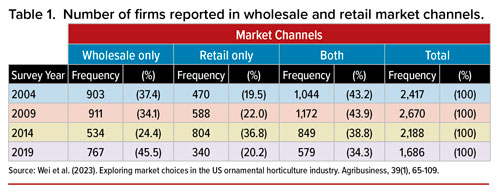

As shown in Table 1, wholesale market outlets have been traditionally the major market channels. The number of firms engaged in wholesale, retail or both market channels was stable prior to the 2014 survey. Likely due to the financial crisis from 2007 to 2009, a significant number of firms exited the wholesale market, while the proportion of firms entering the retail market increased, according to the 2014 survey. By 2019, the number of firms engaged in wholesale markets bounced back, reaching 45% of the participating firms, while the number of firms engaged in retail markets fell back to the pre-2009 level.

As shown in Table 1, wholesale market outlets have been traditionally the major market channels. The number of firms engaged in wholesale, retail or both market channels was stable prior to the 2014 survey. Likely due to the financial crisis from 2007 to 2009, a significant number of firms exited the wholesale market, while the proportion of firms entering the retail market increased, according to the 2014 survey. By 2019, the number of firms engaged in wholesale markets bounced back, reaching 45% of the participating firms, while the number of firms engaged in retail markets fell back to the pre-2009 level.

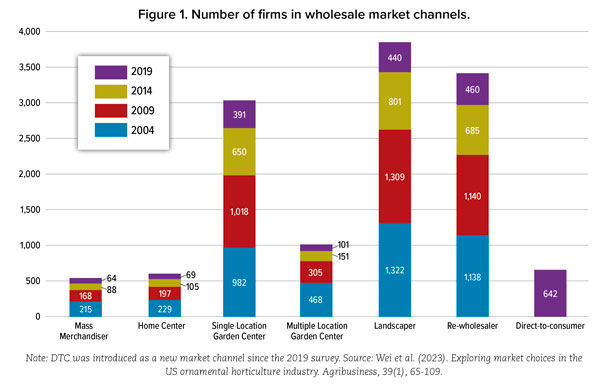

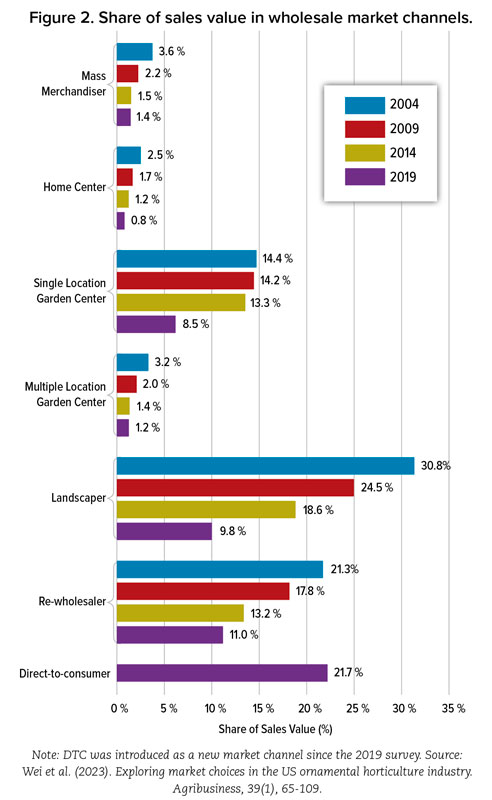

A closer look at the number of firms in each wholesale market outlet (Figure 1) and sales share to each wholesale market outlet (Figure 2) reveal that garden centers (primarily single-location operators), landscapers and re-wholesalers were the dominant wholesale channels prior to the 2019 survey year. Majority of firms (80%) rung up their sales through this trio of outlets, accounting for two-thirds of all sales value in 2004, 56% in 2009 and 45% in 2014. As expected, the number of firms and the share of sales value selling to big box stores have been on slight decline over the last decade and a half (Figures 1 and 2) as the size of approved vendor lists has continued to shrink. For example, one large mass merchant purchased all of their bedding plants nationally from as few as 17 growers last year.

The results from the latest 2019 survey data points to a major shift: sales through direct-to-consumer (DTC) channels are blooming, outpacing some of the traditional wholesale market outlets such as landscapers and re-wholesalers. This change echoes the broader pattern of digital tools adoption with savvy online marketing strategies in the U.S. green industry. While the traditional market channels—garden centers, landscaping companies and re-wholesalers—continue to be a mainstay for industry shipment, the expansive use of Internet technologies, along with diverse social media and e-commerce platforms, has cultivated a new landscape for market outreach and customer engagement. In the 2019 survey, 700 firms (roughly one-third of those surveyed) integrated social media into their business activities. Similar to other industries, the top two leading media platforms are Facebook and Instagram.

The results from the latest 2019 survey data points to a major shift: sales through direct-to-consumer (DTC) channels are blooming, outpacing some of the traditional wholesale market outlets such as landscapers and re-wholesalers. This change echoes the broader pattern of digital tools adoption with savvy online marketing strategies in the U.S. green industry. While the traditional market channels—garden centers, landscaping companies and re-wholesalers—continue to be a mainstay for industry shipment, the expansive use of Internet technologies, along with diverse social media and e-commerce platforms, has cultivated a new landscape for market outreach and customer engagement. In the 2019 survey, 700 firms (roughly one-third of those surveyed) integrated social media into their business activities. Similar to other industries, the top two leading media platforms are Facebook and Instagram.

While an omni-channel approach traditionally provided a buffer against market volatility, there’s a growing trend for larger companies to specialize and concentrate within one primary channel in the wholesale market. This strategic simplification often reflects a choice to focus on key strengths and market positions, which may also be caused by industry consolidation.

Moreover, our research also suggests that landscapers and re-wholesalers are becoming interchangeable channels for certain types of plants. As the industry adapts to new economic realities, our findings suggest a re-evaluation of market channels could be key to sustaining growth and profitability. Firms should consider how to balance their channel portfolio, potentially incorporating more direct-to-consumer engagement in their sales strategy. Establishing a strong online presence is not just for broadening reach; it’s time for businesses to adapt their approaches to meet the modern consumer where they are. GT

Xuan Wei and Hayk Khachatryan are in the Food and Resource Economics Department and Mid-Florida Research and Education Center at the University of Florida. Charlie Hall is in the Department of Horticultural Sciences at Texas A&M University. Marco Palma is in the Department of Agricultural Economics at Texas A&M University. Ariana Torres is in the Agricultural Economics Department and Horticulture and Landscape Architecture Department at Purdue University.