AmericanHort on Tariffs

AmericanHort just sent out a member update with the subject line, “Tariff Truce.” If you haven’t heard, representatives from the U.S. and China met over the weekend and announced a 90-day reduction in tariffs—on both sides—as they hash out a longer and more permanent trade agreement.

AmericanHort’s Kamron Newberry summed up the updates thusly:

90-Day Tariff Pause & Reductions. The U.S. and China have agreed to reduce their recent 125% tariffs to a temporary 10% rate. These changes will take effect by May 14, 2025, and are intended to allow negotiators time to work out a longer-term solution.

De Minimis Tariff Reduction for Low-Value Imports. The administration also reduced a key tariff targeting low-value Chinese imports under $800. The 120% tariff on certain small-value shipments has been lowered to 54%. In addition, a planned increase in the $100 flat fee per postal item, originally scheduled to double on June 1, has been canceled, allowing the $100 rate to remain in place. These changes will take effect on May 14, 2025.

Fentanyl/IEEPA Tariffs Remain. The U.S. will maintain the Fentanyl/IEEPA 20% tariff on certain Chinese imports. This means the minimum effective tariff on many Chinese goods will remain at 30%.

Retaliation Measures Lifted. China will remove non-tariff trade barriers and suspend or eliminate retaliatory tariffs introduced since April 2, 2025. This includes pausing its own 34% retaliatory tariff, while maintaining a baseline 10% tariff for the duration of the talks.

We’ll take a tariff reduction, even if it’s temporary. But I was chatting with an industry person today who said it was the whiplashing (my word) of the on-and-then-off/suspended that has disrupted planning and, frankly, wasted plenty of work hours in figuring out how to handle the tariffs—that are then suddenly on hold.

We’ll see what tomorrow brings.

Prices Rise Slightly

According to the Bureau of Labor Statistics, the Consumer Price Index increased 0.2% in April on a seasonally adjusted basis. It had fallen 0.1% in March. Over the last 12 months, CPI rose 2.3%. CPI is not the same as inflation, but it’s a key indicator used to calculate inflation.

What’s this rise mean? It means prices went up slightly. In fact, it was the smallest 12-month increase since February 2021. Items that are increasing include shelter (0.3%), which accounted for more than half of the monthly increase. Energy is also up (gas and electric up more than gasoline). Food is down a bit—specifically the “food at home” category. Take food and energy out of the equation and those items that went up are household items, medical care, motor vehicle insurance, education and personal care. Airfare, used vehicles, communication and apparel all went down in April.

All this is to say inflation slowed a bit in April. Maybe folks will have a few more dollars in their pockets this month. What will they spend it on? (Hint: See the next item.)

By the way, have you ever taken a close look at the CPI numbers that the Bureau of Labor Statistics puts out each month? Me, neither. It’s interesting, like dissecting a body and seeing all the parts that it’s composed of. That makes me sound like Dexter; I should have used a better analogy, but I think you know what I’m trying to say. Take a look at the numbers yourself HERE.

GMG’s Garden Pulse Analysis

You may have concerns about tariffs and their potential economic repercussions, but your customers don’t—at least when it comes to their gardening. That’s the result of some in-depth analysis that just popped into my inbox from the folks at Garden Media Group and their Garden Pulse: Spring 2025 Analysis.

The report indicates that while other industries show slowing traffic and declining sales, gardening is holding strong if not growing—despite cold weather, consumer caution and tariff-fueled economic anxiety. They found that 2025 early spring garden sales are just 3.9% behind 2024 sales, despite the generally dismal weather we’ve had so far this spring (my local meteorologist tells me this coming Saturday will make two months in a row of rain happening on a Saturday in my area).

“Gardening has always been recession-resistant,” Katie Dubow, president of Garden Media Group, said in a release about the report. “In 2008, 2020, and now again in 2025, we’re seeing a familiar pattern. When people face financial or emotional uncertainty, they return to their roots—literally.”

Dr. Charlie Hall, economist at Texas A&M, chimed in on this, too: “Our spending doesn’t have the same erratic nature as our confidence.” In other words, even if people feel uncertain, their garden purchases remain consistent—and often therapeutic.

“What Does the Data Say?”

Glad you asked because GMG provided some of that.

-

Frontline sales at independent garden centers are nearly identical to those in 2024 and are up 27% from 2020, with strong demand for both edibles and ornamentals.

-

Wildlife garden certifications from The National Wildlife Federation have surged 12% over last year, reaching their highest number of new certifiers in April since 2021.

-

As of March 2025, garden centers using Square have seen an 8.6% increase in processing gross profit and a 9.3% increase in transaction volume compared to 2024.

-

Socials are abuzz about gardening, too. While Facebook and Instagram remain strong, platforms like YouTube and Reddit are now seeing explosive growth—up 32% and 36% respectively compared to 2024, and well over 150% from peak pandemic years.

In all the chaos that these months have presented us, consumers are choosing gardening as a way to regain control, save money, connect with family, and care for their mental health.

What does this mean for you, the garden retailer? “The message is clear—don’t pull back,” The Garden Center Group’s president Danny Summer said in the release. “Even in the face of tariffs and unpredictable weather, gardening continues to thrive. Now’s the time for retailers to stay confident and visible and not discount.”

Here are some suggestions from GMG and the Garden Center Group about what you should be doing now:

-

Reclaim the Story. Position gardening as the antidote to uncertainty. Utilize signage, email and social posts to highlight the value of staying home, digging in and investing in wellness through plants. Speak to the “homebody economy” and invite customers to grow where they are.

-

Host to Grow. Schedule events, classes and hands-on workshops now. Experiences are driving traffic and increasing cart sizes. From seed-starting to pollinator planting parties, give your customers a reason to come—and come back.

-

Stock What Sells. Prioritize high-demand edibles and convenience gardening products. Think beans, tomatoes, cucumbers—plus seed tapes, mats and pelleted options. Emphasize time-saving, success-boosting solutions at every price point.

-

Be the Affordable Luxury. Consumers want their dollars to go further. Today’s top-selling products serve two purposes: beauty and biodiversity, curb appeal and property value, wellness and food security. A plant that feeds the bees and your family? That’s what’s winning the cart.

-

Champion Real-Life Sustainability. Sid Raisch suggests you be the local, sustainable alternative to chain stores and imported goods. Promote growing healthy food without chemicals or heavy shipping costs. Inspire families to swap screen time for green time—building gardens together, learning real-life skills and reconnecting with nature and each other. Gardening offers not just food, but wellness, resilience and self-reliance.

You know I love a good infographic. GMG made a great one with charts showing consumer spending on our products, data on social media mentions and more great info to help you strategize a path forward. Download the complete Spring 2025 Analysis HERE.

The Push to “Buy Local”

In last week’s buZZ! I mentioned the increase in “Made in America” (and Canada, too) marketing and searches for those topics in online searches. This prompted Shannon Kuhrt, President of M&M Wintergreens, to share some of her thoughts on the topic. She states what I think is obvious to everyone: “It’s REALLY HARD to 100% avoid China-made products (right now, at least) when it comes to what has been historically used as non-perishable accents in fresh wreaths and porch pots.” That faux add-ons are manufactured primarily in China, and she’s been looking high and low for domestically produced replacements to no avail.

Then she reminds us that “we are an industry of FRESH PRODUCTS … Since we work on the Christmas/Winter holiday all year, we have been strategically pivoting away from some of these traditionally used accents that come from China and instead have been creating, designing and planning inventory that will accomplish the same purpose and goals of these accents BUT are more local (meaning North America) and not originating from across the ocean. These are going to be much more cost effective as tariffs won’t even be a factor PLUS we feel they are the latest and hottest trend for 2025 and beyond. We wish we could say we were able to do all accents 100% ‘local,’ but we have a great start on this pivot this year with plans to continue in this direction moving forward.”

Shannon also points out that the industry talks a lot about sustainability, and with fresh accents originating from North America, the carbon footprint of them is much lower. Plus, she says, “Sustainably conscious inventory carries weight with the younger generations ... you just have to share the story behind the products. That sells as much as the products themselves.”

This year is a year of pivoting (remember the last time we all pivoted and how that turned out?). “We are truly excited with what we have in the works and are not going to allow the tariffs to be the ‘Scrooge’ of the holidays on our watch!”

“Buy Canadian” is Substantial, Too

A Canadian weighed in on my “Made In America (and Canada, Too)” item from last week, too. This came in from Rebecca Gebeshuber, the Marketing and New Product Development Manager for Van Belle Finished Plants. She tells me the movement to “Buy Canadian” is substantial.

“I wanted to share a bit of insight about ‘Made in Canada’ from our perspective,” Rebecca wrote. “Where we are located in BC, there is a very strong ‘Buy Local’ consumer movement. That has definitely expanded to ‘Made in Canada,’ and we’re hearing it from all of our customers across Western Canada.

“Our account team connected with our retail buyers to see if they wanted us to make any changes before we started spring shipping. All of them responded positively and saw it as a real benefit. Because we design and print most of our plant tags in-house, we were able to pivot immediately and add additional ‘Grown in Canada’ graphics and messaging.”

These are a few of the tag designs Van Belle modified to help people "Buy Canadian!"

Considering both Shannon’s and Rebecca’s comments, I’m wondering if any of you are informing customers about the origins of the products in your store? “An educated consumer is your best customer,” as the saying goes. And the transparency goes a long way in building trust.

Speaking of Canadian Companies

Have you heard that Van Belle Finished Plants has been collaborating with that other wonderful Canadian company Mossify? They’ve been using Mossify’s Bendable Moss Pole THIN in their tropical plant line of 10-in. pothos, philodendron and monstera. Van Belle’s products from this collaboration are for major retail stores in the BC area and will hit that market sometime in August. I’d love to see these grown at scale for IGCs! If you’re interested in wholesale orders, U.S. growers can check them out HERE and Canadian growers HERE.

Mossify’s CEO Lucas Picciolo and Tiago Jacques with Van Belle’s Rebecca Gebeshuber in the center.

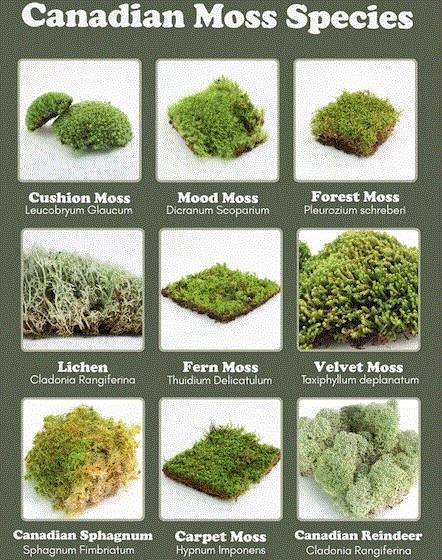

Mossify’s other big news is that they bought a 15-acre farm in Northern Ontario! They are sustainably cultivating more than 10 species of moss that can be used in terrariums, bioactive tanks, bonsai cultivation, decorative top dressing, home décor and wherever else you can think to use them.

“We’re fully committed to regenerative growing practices and see this farm as a major step forward in making moss accessible, approachable and even more approachable,” Mossify’s Head of Media Thiago Jacques wrote. Preorders for the moss, which is shipped dormant but can easily be regenerated, started a few weeks ago with official delivery happening at the end of May. Check out Mossify’s WEBSITE for details.

Bailey Hits Times Square

Bailey Nurseries’ brands were on the big screens of Times Square this Mother’s Day weekend. Yes, that Times Square where the crystal ball drops on New Year’s Eve. The videos of Endless Summer Hydrangeas and First Editions Shrubs and Trees are part of Bailey’s season-long marketing campaign to promote these products and the thrill of gardening.

The Times Square launch consisted of 15-second digital billboard videos running every 15 minutes ALL DAY LONG for four weeks during peak plant shopping season (just clink on the photo above to play the video). “This isn't just a splashy visual in Times Square,” Bailey’s Marketing & Communications Manager Ryan McEnaney shared in a press release. “It's a calculated effort to build brand awareness that ultimately drives retail conversion and complements our season-long engagement campaign.” The launch began with the popular Endless Summer Hydrangeas, and they will be adding First Editions Shrubs and Trees.

Who is gardening in Times Square? No one! But that’s not the point. They are positioning the campaign in the Square to leverage the location’s global reach and to drive consumer engagement. Do you know how often Times Square is shown on TV via network morning shows and etcetera? Do you know how many tourists visit the Square every day? I don’t have the numbers but it’s a lot! Enough to make it worth it for Bailey to run this campaign.

Bailey Nurseries says the Times Square campaign is part of a broader, season-long strategy designed to strengthen consumer connections through multiple touchpoints. It’s the beginning of their marketing approach that will leverage data and insights so they can refine their outreach and hopefully make the most of it to convert folks into purchasers.

“This campaign is about more than just presence,” Ryan said. “It's about making a meaningful impact. Leveraging Times Square’s visibility as a springboard, we aim to foster ongoing consumer engagement, guided by data-driven strategies designed to deliver measurable results.”

Marketing-speak aside, it’s pretty cool to see trees and shrubs among all the other brand-name products that hit some of the most famous billboards in the world!

If you have any questions, comments, suggestions, etc., drop me a line if you'd like at ewells@ballpublishing.com.

Ellen Wells

Senior Editor-at-Large

Green Profit

This week's BuZZ! was sent to 28,292 loyal readers!

If you're interested in advertising on BuZZ! contact Kim Brown ASAP!