Bell acquires ColorPoint Kentucky at auction

Back in February, I wrote here that ColorPoint Kentucky, the former mass market bedding plant operation-turned hemp producer, had gone into receivership and had been sold at auction. Only I didn’t know who the buyer was.

Thanks to public records, I can now confirm that the operation has been purchased in a receivership auction by Central Garden & Pet on behalf of Bell Nursery for a winning bid of $34 million. The deal includes 1.56 million sq. ft. of greenhouse, 150,000 sq. ft. of poly tunnels and 155,000 sq. ft. of warehouse and office space. The only other bidder for the operation was Fernlea Flowers of Delhi, Ontario, Canada.

Now that Bell is part of a publicly traded company, I can’t get the sort of insider answers to my questions like when I could call Gary Mangum on his cell and ask him “What’s really up with this deal, Gary?” The best I could manage was an official statement via email from official Central Garden & Pet spokesperson Liz Nunan:

“The purchase of the ColorPoint Greenhouses and the facilities on the property will enable Central Garden & Pet to expand capacity and build upon our strengths as a leading livegoods provider.”

Not much meat … but it does confirm that they did, indeed, do the deal.

For a brief history, you may recall that Central Garden & Pet, based in Walnut Creek, California, acquired Bell back in 2018; since then, they’ve purchased Hopewell Nursery of New Jersey and Maryland, and Green Garden Products of Norton, Massachusetts, a packet seed and spring garden supply company. I announced both of those deals in February 2021.

With this deal, ColorPoint’s two operations (the other was the former Mid-American Growers in Granville, Illinois, purchased recently by Altman Plants) are both now back in the flower business.

How is Central Garden & Pet doing?

My contact at Central, Liz, asked if she could wait until after their Q2 financial results to get me the desired information. I said yes, of course.

Central is a big company, with $3.3 billion in net sales in 2021. Curious about their performance for the first three months of this year, since they’re in our space in both the garden and pet categories, I checked out the Q2 results.

“Central delivered another solid quarter thanks to strong execution by our team in this challenging inflationary environment,” said Tim Cofer, CEO of the Walnut Creek, California, distributor in the official statement. “Despite the ongoing headwinds, we grew sales and operating income, and importantly, expanded gross margin, and remain on track to deliver our fiscal 2022 financial targets. We continue to make purposeful investments to drive profitable long-term growth.”

Net sales increased 2% to $954 million compared to $935 million a year ago, driven by recent acquisitions, which contributed $52 million to the quarter. However, organic net sales decreased 3.5% compared to the prior year quarter. That doesn’t mean organic products, that means sales of existing businesses (not new acquisitions). That’s not surprising, given the challenging weather thus far.

Gross margin was 30.1%, an increase of 100 basis points compared to a year ago, driven primarily by pricing as well as favorable product mix and productivity improvements, partially offset by cost inflation in commodities, freight and labor. Those are some of those headwinds he mentioned in his quote.

Operating income increased 2% to $107 million from $105 million a year ago. Operating margin of 11.2% was in line with the prior year despite continued inflation and heightened investment spending. The company’s net income was $70 million, a decrease of 4% from $73 million a year ago.

Garden segment results

That was for the whole company—garden and pet. Net sales for the Garden segment increased 3% to $457 million. However, that increase was driven by contributions from recent acquisitions, offsetting a decline in organic sales of 9%. The decline came from chemicals & fertilizer, garden distribution, controls and grass seed, driven by unfavorable weather causing a late start to the garden season.

Pet segment results

Net sales for the Pet segment increased 1% to $498 million, with notable contributions from the company’s dog and cat, outdoor cushions, professional and pet distribution businesses, offset by softness in pet beds (yes, they really wrote that).

Pet segment operating income decreased 2% to $61 million, and operating margin declined 40 basis points to 12.2%. Pet segment adjusted EBITDA decreased 1% to $70 million from $71 million a year ago, largely driven by inflationary headwinds and heightened investment spending, partially offset by improved pricing and favorable product mix.

There you have it!

How was April 30-May 1?

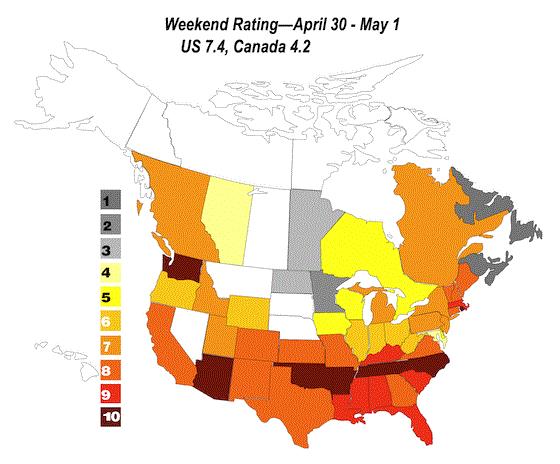

Like last week, I’d say decent in the U.S. (7.4) and unpleasant in all of Canada (4.2) except British Columbia, which scored 7.1, including a pair of 9s and an 8. The foul weather lingered through the entire month of April, making it the worst on record in a few spots (more on that later). The weekend scores are 0.1 below last week’s 7.5/4.3.

Here’s the map:

That’s based on 109 scores from 45 states and 7 provinces (thanks for heeding my plea for more scores from more places!)

Fifteen of you (14%) scored the weekend a perfect 10. It was perfect in a few places. Oklahoma sent in three perfect 10s. Arkansas sent in two, and Arizona and Washington each had a 10 as their only scores. Alabama scored two 10s and an 8, Tennessee and North Carolina each scored 10 and 9, Florida scored 10 and 8.

Joe Ward of Southwood Landscape & Garden Center in Tulsa rated his weekend a beyond-perfect 12, saying, “Best weekend ever. We are currently up 10% for April over PY April and down 5% YTD to PY, but [we are] whittling away at that as each week passes. More importantly, our gross margin % is as strong as PY and our average ticket is running at $117. Hopefully our weather holds out for the next two to three weeks.”

Three of you sent scores of 1, from Minnesota, North Dakota and Manitoba. In fact, I think Minnesota was the place to NOT be in April. The state averaged a score of 2.0, based on scores of 1, 3 and 2. Dismal!

April, on average

April sales never decide a season, I don’t think, although they can provide the early season gravy that adds to a good season or saves a poor one. Let’s look back to see how Aprils of yore have scored compared to this year:

YEAR US/CAN

2022 6.8/4.6

2021 8.4/8.6

2020 6.8/6.8

2019 7.0/6.0

2018 5.4/5.0

2017 6.9/5.2

2016 7.3/7.4

2015 6.7/4.8

2014 6.8/5.3

Avg. 6.9/6.0

Interesting, eh? As much as we maybe have been complaining or worrying, here in the U.S. we are just 0.1 below the nine-year average. Four years have been better, two the same, and two worse.

Of course, 2021 throws off the data a bit; if I leave it out, the average is 6.7, making this year a tenth better than average.

None of this helps you Canadians, who suffered your worst April in my records, does it? Speaking of records, Nanaimo, British Columbia (on Vancouver Island) had its wettest April ever (6.5 in. of rain). And Winnipeg, Manitoba, had its second-wettest April on record—4.6 in. Check out this image from a video sent to me by Ball Seed sales rep Duayne Friesen who lives up there. It was sent to him by a customer, who said the sand bags were holding and the water had stopped rising.

Just in case you think it’s been wet where you are …

Finding perspective

I like when you add a bit of perspective to your weekend analysis. Here are three notes from the field that do just that:

From Abe VanWingerden, Metrolina Greenhouses, Huntersville, North Carolina:

“Eighty percent of the miss is still weather, weather, weather. In our coastal markets (where we have not had extended cold, and rain is normalized), we have seen 7% to 9% growth this season, no matter the chain/format/demographics. We have not seen shifts to smaller sizes or more basic varieties, and we have not seen a move from weekday sales back to more weekend sales.

“But, it’s a compressed season—each weekend in May needs to be Mother’s Day/Memorial Day-level sales. Yes, we did that in 2020 right after COVID hit (after fear/locked gates in April), so it is doable.”

From Beth Weidner, Weeds Greenhouse & Gardens, Tina, Missouri:

“… I wish I could quit comparing to the last two years and somehow factor in my price increases. Traffic was about the same for the month, overall. Sales were up and average sale was up for the month, overall. But… “last year” or “… in 2020,” which were such total anomalies and this year is its own special weird! I need to just quit worrying about where we’re at and enjoy growing and selling plants! And maybe make one of those cocktails you suggested a couple years ago! Or have some ice cream with wine over it … much less complicated and very satisfying!”

From John David Boone, Dothan Nurseries, Dothan, Alabama:

“Great weather. Good and busy. A little short of last year. I think really the days we are having are great days. Just compared to last year they are a little less. But compared to my other 18 years in business, they are great!”

Mother’s Day clock sales solid

Not clock as in cuckoo and alarm and grandfather. I don’t have any data on how they’re selling. Clock as in auction, as in Royal FloraHolland, the giant flower and plant auction in Aalsmeer, the Netherlands. They sent out a newsletter this week that said, “In the two weeks leading up to Mother’s Day, the volume on the Royal FloraHolland marketplace was just slightly higher this year than in the same period in 2021.”

Additionally, “The average price for flowers and plants was 5.5% below last year’s level.” However, they remind us that 2021 was an unprecedentedly good year for floriculture, with exceptionally high prices. This year’s prices are “considerably above” those of 2019 and 2020. “Despite higher costs of living, among other things, the demand for flowers and plants remains good.”

Good news!

A few more tidbits:

There is no clear consumer favorite flower or plant. However, compared to last year, there was better pricing for cut anthurium, cut hydrangea, lisianthus and rose. Among garden plants, mandevilla, hydrangea and lavender are popular this year. And among houseplants, phalaenopsis orchids remain the top favorite, with kalanchoe and hydrangea coming in close behind.

Finally …

Growers, do you know yet what your 2023 prices are going to be?

I didn’t think so.

However, I’m hearing that the big boxes are already asking their growers for pricing, so the topic is out there. I reckon that’s good news, for one main reason: they expect prices have to go up and are preparing for it.

Of course, I’m not so naïve to think that box stores will just roll over and take whatever increase a grower puts out there. They’re tough negotiators—the toughest—and growers have to get creative to get more money, with unique combinations, unique containers and different sizes. I’ve been told that if it is the same as last year, expect to get less money for it.

My question to you growers is this: What are you learning about costs and pricing this season? Are you getting pushback from your buyers? Or are they accepting it? And are you thinking ahead to next season yet? And if so, what’s the plan? Email your thoughts on the topic to me at beytes@growertalks.com.

Feel free to email me at beytes@growertalks.com if you have ideas, comments or questions. Beefs, even ... especially if barbecued!

See you next time!

Chris Beytes

Editor

GrowerTalks and Green Profit

This e-mail received by 25,687 loyal readers!

Thanks to my loyal sponsors, who help me reach the 25,654 readers of Acres Online in more than 60 countries. Want to be one of them (a sponsor, that is)? Give Paul Black a shout and he'll hook you up.