Floriculture sales up, foliage way up, Florida #1, says USDA

Hortistician Dr. Marvin Miller just emailed me his quick first analysis of the just-released 2020 Floriculture Crops Summary. Here’s what he had to say about it (expect a more in-depth analysis in coming weeks):

USDA’s National Agricultural Statistics Service (USDA/NASS) has released its Floriculture Crops: 2020 Summary, which details sales of floriculture production in 17 states. USDA reported that sales were up an estimated 8.6% overall. Yet, if we examine the report and remove the estimates for the smallest of growers, as well as the sales of propagative materials, sales of finished floriculture crops for growers with $100,000 or more in sales were up only 6.8%, according to the report.

Here’s the pie chart:

Examining the different segments of the industry as seen in the Floriculture Production Pie chart of finished floriculture sales reveals that sales of foliage plants increased 22.8% from 2019 to $756.0 million in these states, the largest segment increase in the report. Foliage plant sales accounted for 17.7% of the pie. Sales of bedding/garden plants were up a healthy 13.3% to $2.275 billion in 2020; sales for this segment of the industry now account for 53.3% of the pie.

Unfortunately, sales of cut flowers were down 9.6% to $294.8 million (6.9% of the pie), sales of cut greens were off 0.2% to $89.0 million (2.1% of the pie), and sales of potted flowering plants were down 10.9% to $849.9 million (19.9% of the pie).

The state of Florida finished in the top position for sales of finished floriculture crops, accounting for 24.4% of the sales in the report with $1.04 billion of sales of finished crops. California is now state #2, with sales of $906.2 million in finished crop sales, accounting for 21.2% of the pie. And Michigan, in position #3 with $405.8 million in sales, accounted for 9.5% of the pie’s total sales. Together, these three states accounted for over 55% of the 17-state total.

Don’t forget our Young Grower/Young Retailer Zoom interviews!

If you want to know what the under-35s in our industry think about their careers and our customers, now’s your chance to hear from six of them—three growers and three retailers—in two hour-long Zoom interviews scheduled for next Tuesday and Wednesday, June 15 and 16. Both will start at 1:00 Eastern/Noon Central.

Sign up at www.growertalks.com/webinars.

These six exceptional young talents are the finalists for our annual Young Grower and Young Retailer awards. They’ll be sharing their opinions, ideas and concerns about their chosen profession, and answering the big questions posed by me and fellow moderator Jen Polanz, including:

- How can we better attract and keep talent?

- How do we future-proof our businesses?

- What mediums work best for reaching young consumers?

- How can we prevent burnout in our staff?

- What do you think about the pay levels in horticulture?

- What do you want and expect from your employer?

- What are consumers asking for?

- And much more … including your questions!

Our three Young Grower Award finalists (appearing Tuesday) are:

- Diego Barahona, Costa Farms

- Maddie Maynor, North Creek Nurseries

- Thomas Minter, Loma Vista Nursery

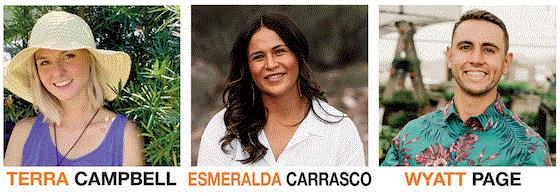

And our three Young Retailer Award finalists (appearing Wednesday) are:

- Terra Campbell, Round Rock Garden Center

- Esmeralda Carrasco, Ponderosa Cactus Nursery

- Wyatt Page, Gill Garden Center + Landscape Co.

Don’t miss this information-packed pair of webinars! Sign up now at www.growertalks.com/webinars.

Sponsored by The HC Companies, AmericanHort, and the Garden Center Group and its partners.

June 5-6: Back to "normal"?

With the exception of some of the northernmost businesses, June always marks the beginning of the slowdown in spring sales, and so it is for 2021, based on the scores you sent in for June 5–6.

And why should we expect anything different? The pandemic is mostly behind us, along with the panic buying and family activity buying and boredom buying that came with it. Plus, competing businesses are opening up, and folks are starting to travel again, which is why the scores of 7.9 in the U.S. and 7.0 in Canada for the first weekend of June are still very solid. I think they would have been even better had not much of the country endured a 90F heatwave.

Here’s the map:

That’s based on 91 scores from 43 states and 5 provinces. You sent in 14 10s (15%)—still a good percentage for this late in the season.

That’s based on 91 scores from 43 states and 5 provinces. You sent in 14 10s (15%)—still a good percentage for this late in the season.

As I did last week, let’s put this in historical perspective:

Scores for the first weekend of June:

2020 8.3/8.8 (34% 10s)

2019 8.2/8.2 (18% 10s)

2018 7.4/6.5 (7% 10s)

2017 7.4/8/9 (13% 10s)

2016 7.3/8.1 (11% 10s)

2015 7.4/8.1 (16% 10s)

You can see that 2020’s late-season excellence was truly an anomaly. This season now seems to be falling back in line with historical trends. Canada was soft … that seems to be due primarily to heat and maybe a mad rush to shop early.

You had some good one-liners to describe the weekend:

“Sales are hot! We can’t have enough plants!” (Colorado, 10)

“Not much left to sell.” (Montana, 10)

“Still going strong.” (Montana, 9)

“Running out of product.” (West Virginia, 8)

“Hot … but still not bad sales.” (Wisconsin, 7)

“Too hot.” (Quebec, 6)

“People seem to be filling in instead of filling up.” (New Jersey, 5)

Where was it best, and worst?

You wanted to be in Oklahoma this past weekend. Folks there sent in three 10s and nothing else. Montana, Ohio and Colorado were also strong, each with a 10 and a 9. Ohio averaged 8.8 on four scores.

There were no truly hideous regions—no rain-outs, in other words. Heat across the East and Midwest seemed to have the biggest impact.

Here’s the regional breakdown:

South 8.0

West 9.0

Midwest 8.1

New England 7.7

East 7.0

Mountain 9.0

Plains 7.2

Northwest 7.0

And in Canada:

Alberta 9.0

British Columbia 8.3

Manitoba 6.0

Ontario 5.7

Quebec 6.0

Your comments

The numerical scores are admittedly subjective. But the notes you provide with your scores paint a picture of what’s really happening across the country(s).

Nevada (10). “No slowdown in strong sales growth over one year ago, building on June 2020 and significantly over the better comparison to 2019 results. As the economy opens up, we thought sales would level off based on excellent May, but first week and weekend of June [were] very healthy.”—Bruce Gescheider, Moana Nursery

Colorado (9). “Finally reached 90F degrees and the parking lot is full and customers are buying.”—Gene Pielin, Gulley Greenhouse

Ohio (9). “Well, my answer is 9, but we had a huge sale, which drove in a ton of traffic so it may not have been that high on an average day at this time of year. Many customers had quite a few full carts, plus we met quite a few who said it was their first time at our nursery. Everyone was upbeat and friendly for the most part. The weather was hot and sunny.”—Amy Draiss, Dayton Nurseries

Ohio (8). “Still going strong—keep quality product in front of the customers for continuing sales. Vegetables, although not as strong as last year, still moving good. Keep the heat down—looking for another 10 days/two weeks!”—Duke Stockslager, Stocklager’s Greenhouse & Garden Center

Iowa (8). “Very hot and humid, but still very steady traffic and good sales numbers It’s not May sales numbers, but very respectable for a hot weekend in June.”—Kate Terrell, Wallace's Garden Center

Virginia (7). “One of our first just totally nasty weekends. Wind, rain, oh my. Sales were still decent despite the weather.”—Mark Landa, Boulevard Flower Gardens

From Oregon

For some reason, you Oregonians were in a chatty mood this week:

Ball Seed’s John Crisp (6): “Cool, rainy—just the way we like it!”

Ed Blatter of Cornell Farm (9): “Cool and wet and even blustery, but not enough to dampen sales too much.”

Ellen Egan of Egan Gardens (7): “My gut-level first reaction was ‘bleh!’ because it was so much slower than it has been. But on comparing to previous years, it was alright, about average. It’s just over, is all. It's not an over-the-cliff drop—just the usual seasonal downward slope."

The change from pandemic season to regular season

These next three comments illustrate the change from pandemic season to regular season. But they also offer the opinion that the growth in sales was real, and hopefully, not temporary:

Massachusetts (7). “Russell’s Garden Center was running 30% ahead of our best year ever YTD until the early heat wave hit. UGH! Well over 90F for three days in a row slowed our business as we competed with people attending New England beaches instead of gardening. With the high vaccination rates, we now compete with restaurants and vacation budgets for disposable income. We’re happy to have had such great increases and believe that things may be more like normal again soon.—Elizabeth Skehan, Russell’s Garden Center

Washington (7). “This June has started out feeling a little bit more like normal than last year, with demand tapering off and customer foot traffic easing up, but I’m so grateful for a strong season once again! Remember, last year we were one of the only ‘fun’ businesses considered ‘essential,’ so all of those people who just had to go spend money ended up in our stores. This year, it’s a very different story, with all businesses open to at least some extent—so the fact that we’ve had as good a season as we’ve had points to people having loved last year’s foray into gardening enough to continue it in earnest this year.”—David Vos, Vander Giessen Nursery

Scores of 7 to 10 for 15 states. “Coming out of this weekend, we can clearly see in the data now that we are holding onto last year’s big gains. That is great news for the industry, as this seems to be our new run rate, and consumers have come back again this second year. No going back to 2019 sales! The only places where that might be off is where we have weather (impacts that moment as it always does) and places where they were out of stock last year this month, but decided to put in additional production this year (i.e. you have it now when you did not last year). Those are the 10s you are seeing on some reports. On the other hand, if you would have told me in February of 2020 that I would be 25% to 35% ahead in March–June 2021 vs. March–June 2019, I would have taken it and run to the bank. Good stuff overall, long-term, for our industry, as long as we produce to meet this demand.”—Abe VanWingerden, Metrolina Greenhouses

British Columbia (8). “Well, up here in Victoria I feel it will be a steady sales period from now to August—a little above pre-COVID average. Three factors affecting sales right now are: 1) Strong early April start to season; 2) weather right now is so-so; and 3) the government opened up restrictions on travel around a long weekend, and you can sense that the public is tired of staying home. I predict that travel will take over customers' priorities and we will see a strong spring because of new gardeners we got because of COVID stay-at-home restrictions. But the general public is ready to get out and travel big time, so don't expect any more records day after day next year—just slightly above-average sales.”—John Derrick, Elk Lake Garden Centre

What’s your view? Do you think we’ve gotten back to “normal”? And how much of the growth will we retain? Weigh in HERE.

Veggies down … less fear of food scarcity?

Of all the plant categories we're selling, I’ve only heard of one that hasn’t performed as well as last year, and that’s veggies. If you have anything left to sell, it’s tomatoes and peppers. Pundits speculate it’s a combination of less fear over the food supply than last year, and perhaps an adjustment to quantities purchased this year, as new gardeners learned the hard way that you don’t need to buy tomato plants by the flat.

Wrote Jeff Jones of Great Gardens in Wyoming, “Greenhouses emptying, out of many items. Surprisingly similar to last year. Edibles not quite as crazy since the grocery stores are well supplied. The fear of being without food to buy seems to have abated since last spring.”

And Caroline Kinkennon of Goose Patch in Iowa said, “I grew 70% garden veggies and 30% flowers. I sold out of flowers and sales have gone ice cold for veggies.”

What have you seen from the veggie market this year compared to last? Let me know at beytes@growertalks.com.

It begs the question …

I hate that phrase because it’s overused, and when it is used it's used incorrectly (it actually means to “assume the conclusion”—petitio principii, as Aristotle would have put it, having not goofed off in high school Latin like the rest of us).

The two crazy seasons we’ve enjoyed (14 strong months in a row, Abe VanWingerden pointed out to me last week) do require that we ask the following questions:

- What will happen this summer as society opens up and consumers are able to travel and eat out and attend concerts and such—will that impact our sales?

- Will June be soft because consumers, anticipating short supply, did their shopping early?

- How many of those supposed 20 million new gardeners came back this year and are still with us, and will remain with us?

And perhaps the biggest question of all:

- Is this level of production and consumption the new normal for horticulture? Or will we find ourselves dropping back down to 2019 levels?

I heard somebody say recently that our industry has experienced 10 years of growth compressed into two years. If so, that could be dangerous and hard to maintain. Much like the Great Toilet Paper Shortage of 2020. It’s not organic growth based on carefully cultivated demand—it was based on impulse, panic and boredom.

What do you think about the questions above (and any others you may have)? Weigh in HERE.

I’ll once again give Abe the last word on the topic, as he says he has reason to be optimistic.

“I am still bullish, as people have invested a ton of time/money/effort in their homes and beautifying their outdoor spaces (gazebos, water features, sunrooms, etc.) that require plants now, so that has a longer term win for us as an industry.”

Let’s hope you’re right, Abe!

See you next time!

Chris Beytes

Editor

GrowerTalks and Green Profit

This e-mail received by 25,317 loyal readers!

Thanks to my loyal sponsors, who help me reach the 25,317 readers of Acres Online in 66 countries. Want to be one of them (a sponsor, that is)? Give Paul Black a shout and he'll hook you up.