10/1/2019

Rebounding Cut Flower Industry

John Dole, Cristian Loyola & Rebecca Dunning

Cut flower production is back! The number of specialty cut producers has been growing. These entrepreneurial businesses capitalize on the interest in local production, selling to specialty supermarkets, bucket trucks and florists or directly to the public at farmers markets, farm stands or even the occasional pick-your-own operation.

One relatively new marketing channel has been the farmer-florist—businesses that design and sell finished flowers to their customers using mainly what they grow on their own farms. These media-savvy businesses bring customers onto their farms—physically or virtually through social media—and sometimes provide classes, books and implements for home gardeners to grow their own cut flowers. Reflecting this change is the fact that membership in the national Association of Specialty Cut Flower Growers (ASCFG) has close to tripled in the last five years.

Identifying a producer’s top needs

The challenge with addressing the needs of the new cut flower industry is determining what issues they’re facing and which ones are most important to them. With that in mind, we surveyed 1,098 ASCFG members between April and June 2017 using Survey Monkey. We received a total of 210 responses for a 19% response rate. The respondents were mostly from the United States (93%) with the remaining from Canada (7%).

Two hundred of the respondents had small businesses with nine or fewer employees (95%), four businesses had between 10 and 19 employees (2%), and four between 20 and 49 employees (2%). There were two especially large businesses with between 100 and 200 employees (1%). Not surprisingly, most of the respondents were owners of their businesses (71%) with the rest either growers (15%) or holding one of several other positions (14%).

Cut flower farms in the United States and Canada are diverse, growing a broad range of crops. Almost one third of the respondents produced or handled 13 to 18 different crops, another one-third produced one to 12 species, and 26% produced 19 or more species.

Zinnias were the most commonly grown or handled crop, being grown by 83% of respondents. Rounding out the top 10 crops were peony (75%), snapdragon (75%), sunflower (75%), dahlia (74%), lisianthus (64%), celosia (64%), Sweet William (55%), ammi (54%) and cosmos (53%). These numbers reflect the most commonly grown crops by those surveyed, but not necessarily the most valuable crops.

A total of 130 species were reported to be grown by the respondents. The total list of species grown by ASCFG members is much larger than 130, as respondents also listed a number of broad categories of cut products that could include many more species: edible flowers (1 respondent); fillers (3); flowering branches (4); foliage (8); grasses, grains and millets (14); herbs (3); natives (2); perennials (3); vines (1); and other woodies (4).

Major production issues

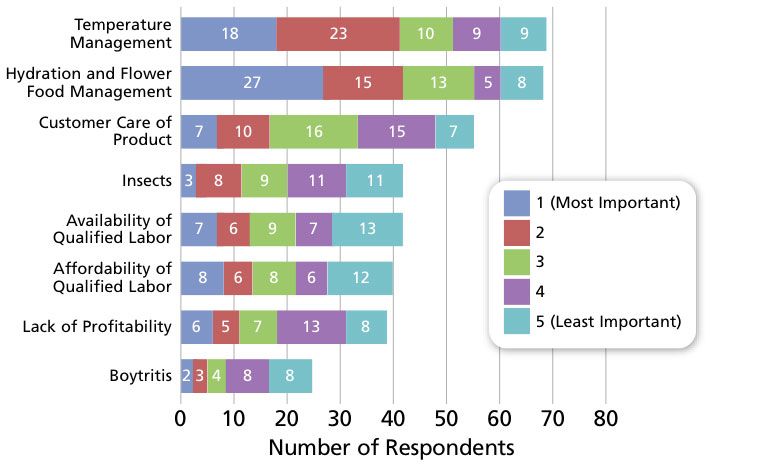

One of the goals of the survey was to learn the major overall production and post-harvest issues faced by the industry. Not surprisingly, pest management was at the top of the list for production (Graph 1), with insect and disease management coming in as the first and third most important.

The second highest ranked problem—timing—can encompass a range of issues. Based on comments in other parts of the survey, we understand that crop timing meant determining the correct harvest stage for some crops, while other respondents were referring to those crops that had too short of a harvest window or flowered all at once. Still others referred to a lack of control when the crop was ready to harvest due to weather conditions.

Suppliers will be glad to see that poor-quality propagation materials ranked as the least most important issue. However, there’s apparently some room for improvement, as 16 respondents included the factor in their top five most important issues and one respondent ranked it as their most important issue.

It was interesting to see that insufficient demand was the second least important issue. We suspect the response to that factor would have been different if we conducted the survey during the height of the Great Recession. Having said that, some businesses were having sales challenges, as almost 1/3 of respondents (out of 128 who answered the question) ranked the issue among their top five and nine listed it as their most important issue.

Major post-harvest issues

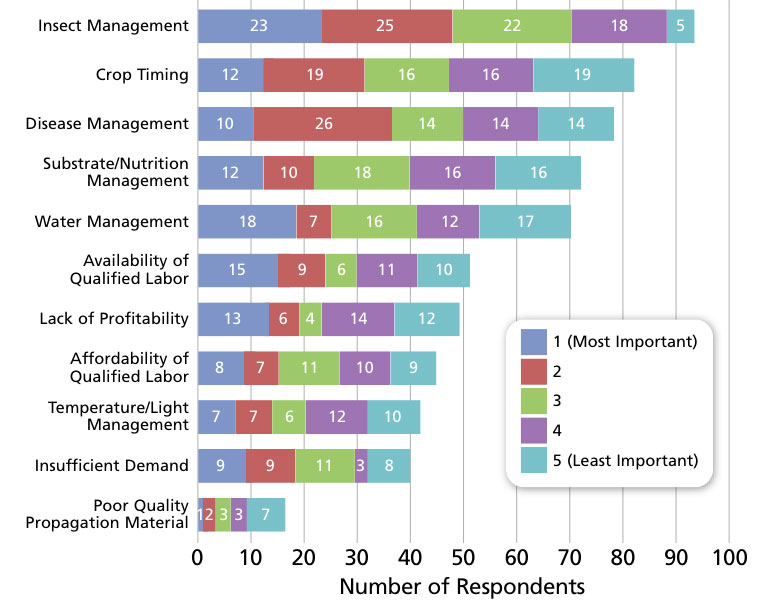

Major post-harvest issues

For postharvest, the two major issues were temperature management and hydration, and flower food management (Graph 2). Of course, both are critical to getting a long vase life for cut flowers. Customer care of product came in third and is a constant frustration for flower growers. Who hasn’t seen their lovingly made bouquets stuffed in between the melons and tomatoes or left in a hot car far too long.

Graph 1. Respondents were asked to select the five most important production issues for their business and rank them from 1 to 5, with 1 being most important. Each number from 1 (most important) to 5 (least important) was used once for each respondent. Numbers in the bars are the number of times the ranking was recorded for each production issue (n = 128).

Botrytis was ranked the least most important problem and profitability came in next to last in importance. As noted above, lack of profitability would likely have ranked much higher if the economy wasn’t doing as well.

We also asked respondents to tell us about the production and postharvest problems they were dealing with on individual crops. For the postharvest issues, we asked about on-farm problems, shipping and transportation problems, and customer care problems.

We received thousands of responses. The challenge was distilling down the responses to a list we could manageably report on. Even after condensing many similar responses together we still had 16 tables in the scientific publication we wrote on the project—far too many to show here. The full article is available online and can be reached at: tinyurl.com/cutflowersurvey.

For the top 31 cut flower species, we listed 87 production issues, 28 on-farm postharvest problems, 18 shipping and transport problems, and 32 customer complaints.

Some cut flower species had more problems than others. Respondents were given the option of reporting that they had no major issues with a particular crop and 39% did so for production of viburnum, 33% for yarrow and 32% for ammi.

Some cut flower species had more problems than others. Respondents were given the option of reporting that they had no major issues with a particular crop and 39% did so for production of viburnum, 33% for yarrow and 32% for ammi.

Graph 2. Respondents were asked to select the first most important postharvest issues for their business and rank them from 1 to 5, with 1 being most important. Each number from 1 (most important) to 5 (least important) was used once for each respondent. Numbers in the bars are the number of times the ranking was recorded for each postharvest issue (n = 76).

On the other side of the spectrum, everyone reported at least one major production issue for dahlia and 98% did so for ranunculus. For post-harvest challenges, Dutch iris was the least problematic and rose the most.

As with the overall production and post-harvest issues, many of the species-specific problems involved plant pests, such as insects, diseases, vertebrate animals and weeds. No surprise to anyone, for example, was that almost 30% of zinnia growers had problems with powdery mildew or that 30% of sunflower growers reported issues with various vertebrate animals.

A host of other production issues were listed by respondents, ranging from air flow (insufficient air flow can contribute to disease problems with anemone and ranunculus) to weak necks, which was a problem for 11 species, especially for marigolds. Breeders should note that “obtaining more desirable cultivars” was listed for eight cut flower species, handling the “requirements of the different cultivars” was noted for two species and “color availability” for five species.

Fewer postharvest issues were reported. The greatest number of problems reported for the most species were hydration and holding, temperature management, timing and vase life.

Periodic updates to the survey, perhaps conducted every five years, can help keep researchers and suppliers on top of the needs of the cut flower industry as it continues to grow. GT

John Dole is professor and Associate Dean at North Carolina State University. Cristian Loyola received his MS degree from NC State and is currently working at Altman Plants. Rebecca Dunning is Research Assistant Professor at NC State. Portions of this article are being co-published in The Cut Flower Quarterly.